In a volatile market, Bitcoin cash stays above the mark of $490. It came into existence as the outcome of a Hard fork in the Bitcoin blockchain.

In May, Bitcoin cash showed a small high by hitting a mark of $524, and the market cap stood at $755.66 million. While reviewing a 7-day graph, it showed a gain of 0.29%, which is below expectations as per CoinMarketCap data.

Source: CoinMarketCap

BCH Price Prediction

Source: Trading View

The bitcoin cash market cap topped $9.7 billion and showed a 3.4% return in the current month, as per CoinMarketCap. In a weekly time frame, this token hit the mark of $524, trying to gain a new high. With two big candles, BCH tried to create a bullish sentiment by reaching a Fibonacci level of 34.02%

The trend is heading towards a resistance of $530 to gain its lost momentum. At the start of the previous month, Bitcoin cash managed to reach a 3-year high of $701, gaining 51% growth on the asset. It is expected to hit a mark of $600 in some upcoming months.

The Bollinger Brand showed gaining momentum, indicatine increasing buyer sentiments, which may result in a price surge.

At the time of writing Bitcoin Cash is trading at $492.7 with a market cap of $275.8 million. In the daily graph, the price is down by 0.72%, however, showing a positive sign in a weekly and monthly graph by 0.29% and 3.43% respectively.

Can Bitcoin Cash Hit a Mark of $1000?

After the Halving event, Bitcoin Cash experienced a flood of investments, making it trade above $700. After a high price surge, BCH faced selling of tokens in large units, which dragged its price back to almost 12% at $612.

Source: TradingView

Bitcoin Cash miners bought $242 million worth of BCH between March 29 and April 3. This could make investors more optimistic and push the BCH price towards $1,000 after the halving event.

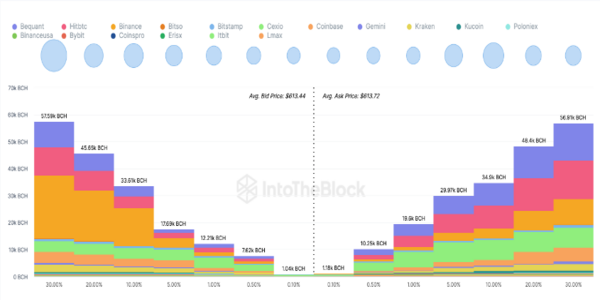

IntoTheBlock’s Exchange Order Books chart supports this positive prediction. The chart shows the total BCH buy and sell orders on 15 major crypto exchanges.

Some buyers have placed orders for 175,000 BCH, while there are only 168,000 active sell orders at the current prices.

Source: IntoTheBlocks

Since there are now 7,000 more buy orders than sell orders for Bitcoin Cash, prices could go up soon. However, there are 29,970 sell orders at the $640 level, which could be a strong barrier.

By viewing all sentiments, if Bitcoin cash manages to cross the mark of $701, the next stop is then $1000.Conversely, if it drops its value, the next support is at $400.

Disclaimer: The article is available just for informational purposes. Don’t consider it as legal or financial advice, as BTCProNews is not accountable for any loss. Do your work before investing in the crypto as you can lose your assets.