The Bitcoin price and the global cryptocurrency market have recently been experiencing a downturn, with BTC struggling to reach its previous highs.

Investors are worried because the price keeps going up and down a lot, especially with the Bitcoin halving event coming up on April 20, 2024.

This event usually affects how much Bitcoin is available and how much people want it, making the market even more uncertain. While Bitcoin deals with all these issues, experts and investors are watching closely to see where it might go next, whether it’s towards $50,000 or $70,000.

Bitcoin Price Performance in the Market

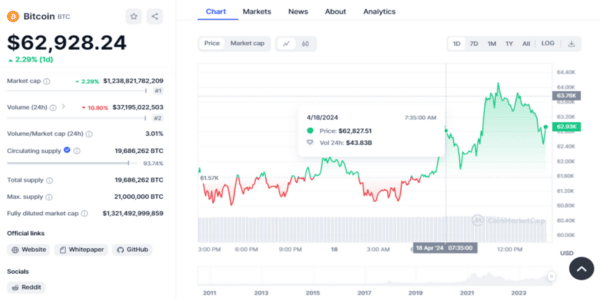

In the past day, Bitcoin price went up a bit, rising by 0.67% to reach $62,913.33 today. While it’s a small improvement for now, the overall trend over the past week and month hasn’t been as good.

Bitcoin’s value dropped by 8.79% in the past week and 6.21% in the past month, which might be concerning for investors seeing their assets lose value.

Despite facing recent challenges, Bitcoin remains the leading cryptocurrency in the market, with a market capitalization of approximately [market cap value.

In the past 24 hours, BTC seen a rise of 18.17% to reach a market cap of $37.05 billion, suggesting a decrease in market activity. However, with a volume-to-market-cap ratio of 3.01%, the market is still active. Just a month ago, on March 14, 2024, BTC hit its all-time high of $73,750.07.

After that, the Bitcoin price has dropped by around 15%, indicating a correction from its all-time high. Investor and traders are conscious about this recent instability in the market.

Source: CoinMarketCap

Bitcoin Price: $72K Target with $60K Support

Some experts say if Bitcoin’s price drops below certain levels, it could mean trouble for the market. They’ve noticed that most people are buying and selling Bitcoin around $60,000, and there isn’t much support if it goes lower.

Experts don’t think it will drop to $40,000 because not many people are trading there, but they do think there could be a sudden rise in price if it goes up to $72,000.

Compared to how things were going in 2021, when the market was doing well, it seems we’re in a similar place to where we were in September. There’s a chance things might get worse before June. Some experts think the market could still improve in the next few months.

If Bitcoin drops below $60,000, it might fall further to somewhere between $58,000 and then $54,000, with a target of $50,000.

Bitcoin Price Prediction

Looking at the technical analysis data, Bitcoin’s future is a bit uncertain, with some factors suggesting its price might go up and others suggesting it might go down. Important things to think about include moving averages, oscillators, and the MACD.

In the short term, when we look at moving averages over 10, 20, and 30 periods, they show a bearish trend because Bitcoin’s price is below these averages. But when we consider longer periods like 100 and 200, Bitcoin’s price is higher than these averages, which suggests its price might keep going up for a while.

The MACD level indicates a selling trend, which could mean the current downward trend might continue.

If Bitcoin’s price goes down, it could find strong support at levels around 53,650 and 62,599. This could help Bitcoin bounce back from a downward trend.

But if Bitcoin’s price goes up, it might face resistance at levels around 73,662 and 77,080, which could make it harder for the price to keep rising.

Right now, based on these technical indicators, it’s hard to predict Bitcoin’s price. It could go down in the long term but might go up in the short term.

If Bitcoin starts to go down, it might drop to around $50,000, which is the support level of a certain moving average. But if it goes up, it could reach $70,000, especially if it gets past key resistance levels.

Source: TradingView

Closing Thoughts

Even though it’s hard to tell what’s going on with Bitcoin right now, things might start looking up after the next halving event. How Bitcoin moves next will depend on how it deals with certain important levels in the market. Traders and investors should keep an eye on technical signs and big-picture economic factors to see if Bitcoin will hit either $50,000 or $70,000.