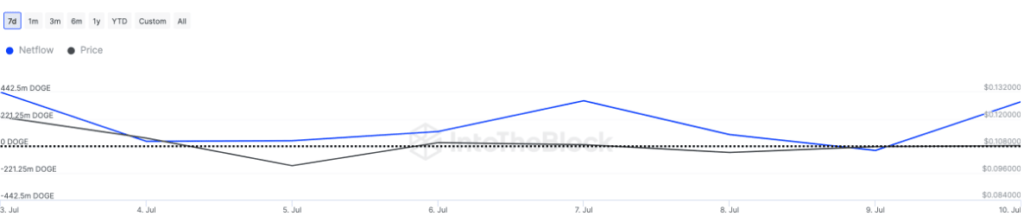

It has also revealed that Dogecoin (DOGE) has witnessed an increase in its whale activity and net inflows, which have increased by a massive 868% within one day.

The observed on-chain activity regarding DOGE helps reveal the longer bullish sentiment levels among market participants in this meme coin.

Whale netflow reveals many DOGE flowing to major holders, reaching 364. 38 million has risen to DOGE from the previously negative figure in the same period.

As observed from the above wind directions, the net inflow is a powerful indicator of the huge acquisitions made by the whales and other investors, which total more than 0.1%.

This high level of buying activity during what may be the market lows indicates continuing investor confidence, which, in turn, points to the potential for price appreciation for Dogecoin.

Major Dogecoin holders have amassed 417. 68 million DOGE, with outflows from these wallets slowing down to 85.5 million. This reveals that holding sentiment is rising, and large holders are not selling DOGE as frequently as before 53.3 million DOGE.

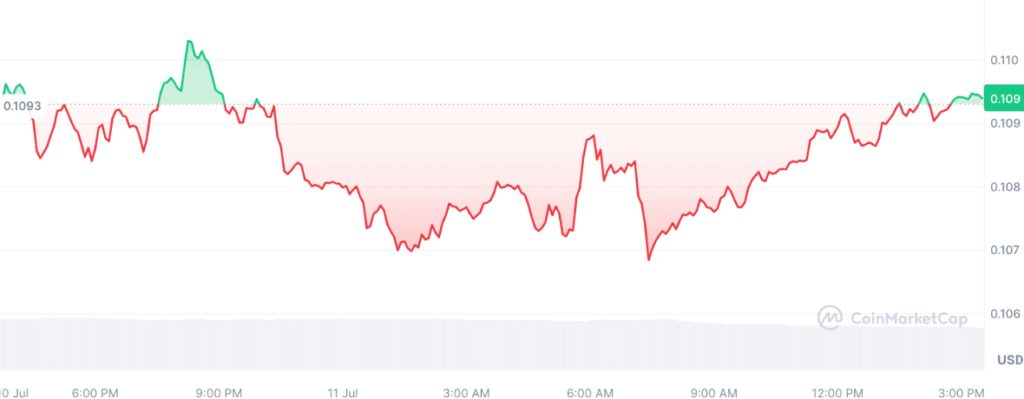

DOGE Surges Higher as Large Holder Buys Dominate Major Market Trend

Disclaimer: Cryptocurrency investments are considered high-risk and may result in an entire lack of capital; the facts provided are widespread, and beginners are not advised to spend money on shares. The increase in these network indicators means that more prominent individuals in the DOGE market participate in activities and demonstrate positive expectations for the meme cryptocurrency. Despite this, the data indicates that key investors have recently intensified their buying activity, which signals optimism for the future development of Dogecoin.

Looking at Dogecoin recently, it is evident that the Bulls are active from the clear side with substantial accumulation by whales. This steep rise in net inflows and the decline in outflows bolstered key market participants’ positive sentiments, which may soon spur higher growth for DOGE.

Disclaimer: Cryptocurrency investments are considered high-risk and may result in an entire lack of capital; the facts provided are widespread, and beginners are not advised to spend money on shares.