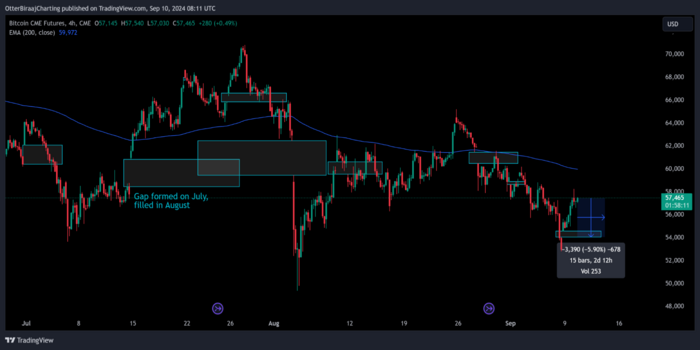

Bitcoin futures gaps on the CME have consistently been filled by the price every time in the past three months. Over the weekend, another gap appeared around $54,000.

On September 9, Bitcoin’s (BTC) price jumped 6.5%, reaching as high as $58,153. This increase followed a weekly close above $54,000, helping BTC stay above its 50-week EMA levels.

Bullish traders are optimistic that expected Fed rate cuts and historically positive market conditions in the fourth quarter will drive a strong rally. However, a possible dip back to $54,000 might happen before Bitcoin can push past the key $60,000 mark.

Will Bitcoin fill the CME gap before its next Breakout?

Bitcoin futures trading can create gaps when the closing and opening prices of trading days don’t match. These gaps occur on the Chicago Mercantile Exchange (CME) because it closes on weekends, unlike the 24/7 cryptocurrency markets.

Traders use CME gap analysis to spot potential areas where Bitcoin might retest during a breakout. These gaps can act as support or resistance points before the price moves up or down.

At the press time, there’s a CME gap between $54,000 and $54,450, which is about a 6% drop from Bitcoin’s current price.

In the third quarter, Bitcoin made 10 CME gaps, all filled during trading hours. Some gaps fill in a few days, while others take weeks. For example, a gap between $57,800 and $60,900 from July 12 wasn’t filled until Bitcoin’s drop in August. So, it’s quite likely these gaps will eventually be filled.

It’s key to remember that CME gaps don’t always need to be filled immediately. As mentioned earlier, Bitcoin might keep climbing before coming back to fill the current gap. Still, DanCrypto, an independent trader, points out that

As always, these don’t have to get filled, but in a ranging environment, they often do.”

When looking at liquidation heat maps, the key levels are $54,250, $53,440, and $52,300. These levels match up with the CME gap and the lower end of the range Bitcoin has been trading in for several months, making a retest of these levels more likely.

The $45,000 mark seems to be acting as the “floor” or lowest point for this bull market cycle.

Bitcoin has moved above the 50-day EMA level, but it’s now hitting resistance at the 100-day EMA and could also face resistance at the 200-day EMA soon.

This means Bitcoin’s price might try to reach $57,830 and $58,500 a few more times before possibly dropping in the next week or two.

In simpler terms, Bitcoin might dip down to the $53,500-$54,400 range—where the CME gap is—before it can break out of its current trading range and start a new rally.

#Bitcoin News #BTC Price Prediction