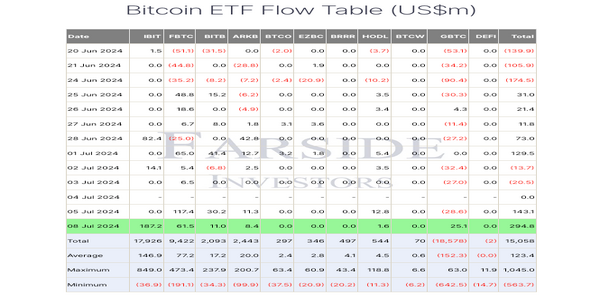

The United States-listed Spot Bitcoin ETF reached the daily highest inflow of funds over a month. On July 8, 11 Bitcoin ETFs reached the highest inflow of $295 million in funds.

Black Rocks ETF led the way by seeing a significant inflow of $187.2 backed by Fidelity’s Wise Origin Bitcoin Fund which remained second in the list by gaining $61.5 of funds inflow. Greyscale Bitcoin ETF also contributed by gaining $25.1M of funds.

Since June 5, it has been a massive day when BTC ETF crossed a milestone of $488 M in fresh capital.

This happened as the market collapsed after the large BTC sales by the German government and Mt. Gox creditor repayments at the start of this month.

By now a total of 26,200 BTC has been paid by the aMt. Gox which to the creditors and market makers is worth almost $1.5 billion. According to Arkham Intelligence data the platform still holds 27,460 BTC which is worth almost $1.57 billion

Meanwhile, there are rumors that $8.5 billion in BTC could flood the market in the coming months. The Mt. Gox started repaying those who lost their funds in the 2014 hack. Some analysts are predicting that Mt. Gox’s Bitcoin sales are exaggerated.

The price of Bitcoin has been shaking over the last two weeks, witnessing a drop of as low as $53,600 on July 5, and at the time of writing, BTC is trading at the $57,606 mark.