Bitcoin volatility seems to be low before a major bull run. Trends suggest a Bitcoin price prediction of $100,000 to $150,000.

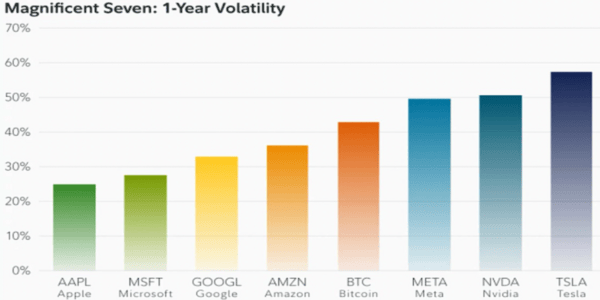

Bitcoin‘s instability shows a major drop when compared to market-leading tech companies like Tesla, Meta, and Nvidia. This indication hints to investors that Bitcoin is becoming a more stable and mature asset.

Bitcoin Leads Over Several S&P 500 Stocks

As of today, Bitcoin’s one year realized instability, reflecting the standard deviation of returns from the mean market return, stands at almost 44.88%. When comparing it to other tech companies like Tesla, Meta, and Nvidia, their market volatility rates exceed.

Comparison of BTC and other volatility, Source: Bloomberg

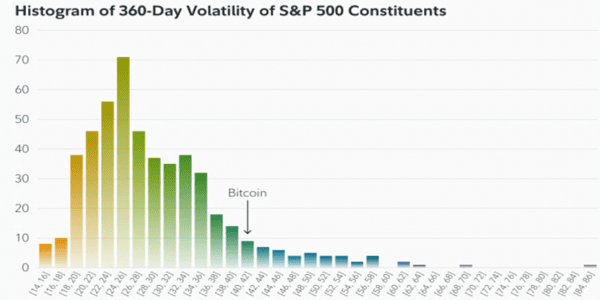

A recent report shared by Fidelity Investment exposed that, while roughly comparing the volatility of 33 companies out of 500 companies, BTC showed lower volatility.

“Bitcoin was actually less volatile than 92 of the S&P 500 stocks in October of 2023 when using the 90-day realized historical volatility figures. Some of these names are also large-cap and mega-cap stocks.”

Source: Bloomberg

Bitcoin and Gold: Parallel Volatility Trends

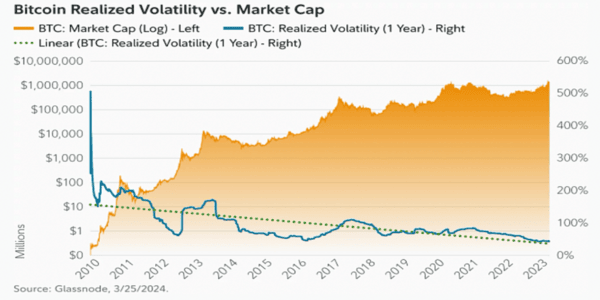

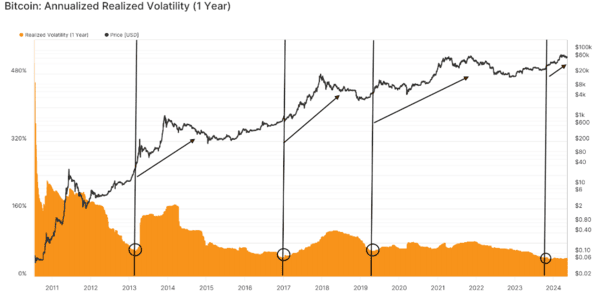

In the developing years, Bitcoin‘s annualized volatility rate was over 200%. This is a common trend among new assets, as a lot of people are getting involved in it. This new inflow of funds represented a smaller proportion of the total capital base.

The new investments in the asset do not have a major impact on the price or the decisions of marginal buyers and sellers. As said in Bitcoin’s long-term volatility chart below, the volatility becomes stable over time.

Source: Glassnode

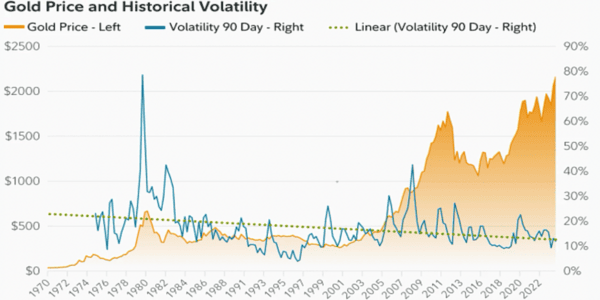

The recent Bitcoins volatility resembles the Gold, in the early trading times. Similar to gold, Bitcoin also experiences a phase of discovering its price, starting with lots of ups and downs, but this volatility tends to decrease as the market becomes more established.

In 1971, after the separation from the U.S. dollar, and in 1974, the legalization of private ownership, the price of Gold rose in response to inflation. In the outcome, the volatility of gold exceeded over 80 in the early 1970s, which is twice that of BTC in April 2024.

Source: Glassnode

After establishing, Gold became a more stable asset with a more stable price range, and its volatility decreased. The same suggestion is for the BTC. As it moves towards a more stable asset class, it is becoming more stable as it becomes more popular and accepted in the financial world.

A major piece of evidence is comparing the volatility of 44.88% when BTC is performing above $60,000, to 3 years ago, when it was at the same price with a volatility of 80%.

“What this may be pointing to is a growing belief that Bitcoin is maturing, further accelerated by the landmark approvals of several spot Bitcoin exchange-traded products in the U.S.,” stated Fidelity researcher Zack Wainwright, adding:

“Bitcoin was nearly half as volatile in 2024 at $60,000 when compared with 2021. When putting this all together, a thesis pointing toward a growing acceptance of Bitcoin due to potential maturation begins to emerge.”

Anticipating a Significant Bitcoin Price Surge?

Realizing low volatility in BTC, is an indication of a major price increase, as the sentiments of existing and new BTC investors rise after stability in price.

Source: Glassnodes

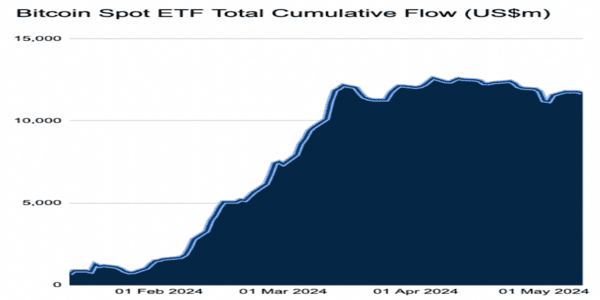

As of December 2023, BTC volatility stood at 43%. Since then, the price spiked to almost 75%, helped by the demand for spot Bitcoin ETFs, which gathered funds of almost $11.68 billion.

Source: Farside Investors

The head of Blackrock digital assets, Robert Mitchnick, stated that from the coming month, we would have more big participants in BTC ETFS, like sovereign wealth funds, pension funds, and endowments engaging with spot Bitcoin ETFs.

For institutional investors, certain risk management protocols, and lower volatility of assets indicate more predictable and stable returns. This aligns with their strategic goals.

“It’s very important to remember that this takes time; these companies are just starting to do their due diligence,” market analyst Scott Melker argues, adding:

“The massive institutional flood of money that will drive Bitcoin to all-time highs.”

Melker predicts the price of BTC to be $100,000 to $150,000 due to the inflow of BTC ETFs.