The spot Ethereum ETF witnessed the first massive inflow of $34 million after bleeding for four consecutive days, since its launch. After 7 days of its launch, the asset encountered a flood of outflow led by Grayscale’s Ethereum Trust which made the asset lose its worth in the beginning trade.

After the approval of the spot Ethereum ETF from the SEC, the asset became the center of attention for its possible demand and performance. Some expert’s analyses showed that the asset will not get as much attention as the Bitcoin ETF due to unclear narratives, demand, and media narratives.

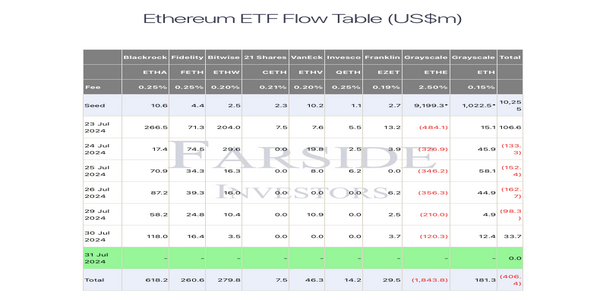

Katherine Dowling, Bitwise CCO expected Ethereum to gather only 20%-30% of inflows when compared to Bitcoin ETFs. The Bitcoin ETF funds saw $1.05 billion in trading volume, about 24% of what Bitcoin ETFs did on their first day, and $107.8 million in inflows. This was achieved despite $484 million being withdrawn from ETH ETF.

Ethereum ETF saw a major outflow in funds immediately after its launch, witnessing a 5% drop in its volume, with an outflow of $113.3M. Analysts still analyze the performance of the asset as excellent, the total volume did not drop much after the major outflows.

Green Day Puts a Stop to Negative Flow Streak

The outflow trend ends on July 30, when the asset sees a major inflow of $34 million in funds. Blackrock’s iShares Ethereum Trust injected $118 million of funds where the total inflow remains at $ 33.7 million on Tuesday according to Farside Investors data.

The ETH ETF saw a net outflow of $120 million, the lowest since the spot ETFs launched. The asset’s outflows dropped by 75% from the $480 million lost on the first day. This slowdown indicates that Grayscale’s losses, about $1.84 billion on July 30, are decreasing, and the funds might regain their momentum.

President Nate Geraci stated on X that the ETF is on the list of the top 15 ETFs launched this year.

A senior crypto analyst, Mads Eberhardt, shared data with his audience on X by showing that “BlackRock’s and Fidelity’s Ethereum ETFs have seen about one-third of their respective Bitcoin ETF inflows.”