The British Colombia Security Exchange found David Smillie, ezBtc’s founder illegally using customer funds for his personal use, resulting in a significant loss in customer assets.

The Canadian cryptocurrency exchange fraud at ezBtc and its founder committed fraud against its customers by using 13 million Canadian dollars (9.5M USD) of their crypto investments for their personal use, spending them on gambling.

The BCSC, a security regulator in Canada found that the ezBtc exchange was illegally spending investors’ money for their purposes. In around September 2019, the exchange went offline and was completely shut in 2022, however, the owner claims that all the crypto assets are safe and stored in a cold wallet.

In the time of exchange operations between 2016 to 2019, the platform holds 2,300 Bitcoin and over 600 Ethereum from investors.

According to the British Colombia Securities Exchange reports, about one-third of the user’s funds were spent for personal use.

“We find that in aggregate, 935.46 Bitcoin and 159 Ether were transferred by ezBtc to Smillie’s exchange accounts and/or to CloudBet and FortuneJack. The transfers to the two gambling websites were sometimes direct from ezBtc, and sometimes indirect from ezBtc to Smillie’s exchange accounts and then to the gambling websites.”

The penal further concluded that because David Smillie and ezBtc’s customers bear heavy losses, they cannot withdraw their assets.

The sanction will be ordered by Sep 24, and the sanction can include fines or exclusion from trading activities. For the record, ezBtc and the founder were not at the hearing, however, the founder of the exchange was present through an attorney.

Crypto Adoption in Canada Lags Behind

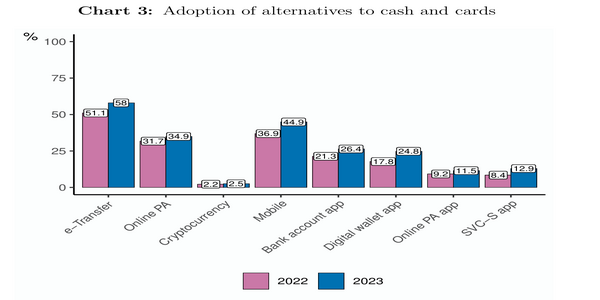

The major crypto scams contribute to the slow adoption of crypto assets in Canada where less than 3% of the population are adopting BTC or other crypto assets for payment.

Concerning the other choices of cash and card, to transfer the money one has a chance to make the e-payment between the Canadian people. It is a way to transfer money through email or phone numbers.

The main reason that has escalated the slowness of this Geldanlagearet is that people never want to stop the use of conducting cash payments.