In Q2, venture capital poured $685 million into crypto infrastructure projects, highlighting their dominance in funding. Despite a decrease in the total number of deals, crypto startup investments saw a slight increase in venture capital compared to the first quarter, according to Pitchbook.

Crypto Startup investments: Big wins and slowdowns

On August 9, Pitchbook reported a 2.5% increase in total invested capital but a 12.5% drop in the number of deals compared to Q1.

Pitchbook suggests this could indicate growing interest from institutional investors.

“With investor sentiment improving and no major market setbacks, we anticipate that investment activity will keep rising throughout the year,” Pitchbook stated.

The report also highlighted that infrastructure projects were the top recipients of funding in Q2. Notable raises included $225 million for the layer-1 platform Monad in a Series A round, $100 million for the DeFi protocol BeraChain in a Series B round, and $70 million for the Bitcoin restaking platform Babylon in an early-stage round.

Pitchbook also highlighted two major funding rounds: decentralized social media protocol Farcaster raised $150 million in a Series A round, reaching a $1 billion valuation, while blockchain gaming platform Zentry secured $140 million in an early-stage round.

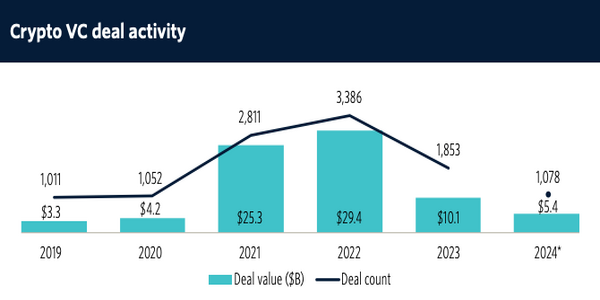

Despite these big wins, overall funding for crypto startups has slowed compared to the high levels of 2021 and 2022, which saw $25.3 billion and $29.4 billion raised, respectively. In 2023, total investment for crypto firms hit $10.1 billion, with projections estimating $10.8 billion for the year at the current pace.

The report also observed that early-stage fundraising for crypto startups has become more competitive, while later-stage funding is less so.

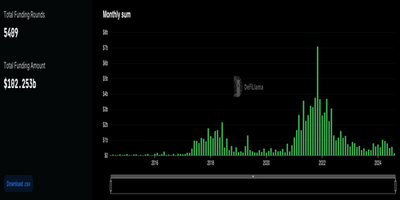

DefiLlama reports that over $102 billion has flowed into the blockchain industry through 5,400 funding rounds since June 2014.

This comes just a few months after Pantera Capital and Paradigm aimed to raise $1 billion and $850 million, respectively, for their new crypto funds.

A $1 billion raise from Pantera Capital would be the largest crypto funding event since May 2022, when Andreessen Horowitz (a16z) broke records with a $4.5 billion raise.

Despite a16z’s impressive $7.2 billion fundraising in May for tech sectors like AI and gaming, they opted not to boost their cryptocurrency fund.