Ripple Labs faces a $125 million penalty after a New York federal judge’s ruling on XRP sales. The decision includes an injunction to prevent future violations but marks ripple partial win. Despite the fine, XRP’s recent price surge might offset the impact, and Ripple’s ongoing legal battles with the SEC continue.

On August 7, Judge Analisa Torres from the Southern District of New York ruled that Ripple must pay $125 million after it was found to have violated securities laws in 1,278 institutional sale transactions.

This penalty is much lower than the $1 billion in disgorgement and interest, plus $900 million in civil penalties, that the SEC originally sought.

SEC appeal denied; Settlement reached on executive charges

The judge’s decision comes after a July 13, 2023 ruling, which found that Ripple’s direct sales of XRP to institutional clients violated federal securities laws. However, Ripple’s sales of XRP to retail customers through exchanges were deemed not to breach any securities laws. The SEC’s attempt to challenge this part of the ruling was unsuccessful.

Along with the financial penalty, Judge Torres issued an injunction to prevent Ripple from future violations of federal securities laws.

While she didn’t find Ripple guilty of any violations since the SEC filed its lawsuit in December 2020, she noted the company’s tendency to “push the boundaries” of legal orders, especially with its “on demand liquidity” services. The judge expressed concern that Ripple might eventually cross legal lines, if it hasn’t already, which led to the issuance of the injunction.

The injunction requires Ripple to register any future securities sales. The SEC is likely to appeal the July 2023 ruling now that sentencing has been imposed, especially after their previous request for an interlocutory appeal was denied by the judge.

Additionally, Ripple and the SEC reached a settlement on charges involving CEO Brad Garlinghouse and other executives after the appeal was denied.

Ripple partial win: $125M fine vs. XRP price surge

Fred Rispoli, Senior Managing Partner at Hodl Law, called the ruling a significant win for Ripple. Despite the $125 million fine, he noted that Ripple’s gains from the recent XRP price increase could offset this amount.

Rispoli emphasized that current XRP sales after the complaint are not automatically in violation of federal law, and the SEC’s failure to secure a blanket injunction on all institutional sales, particularly related to ODL, was a major loss. He also pointed out that the lack of disgorgement was a significant defeat for the SEC, along with the judge rejecting the idea that Ripple recklessly ignored regulatory requirements.

Stuart Alderoty, Ripple’s Chief Legal Officer, pointed out that the court rejected the SEC’s claims of recklessness and emphasized that there was no fraud or intentional wrongdoing involved, nor did anyone suffer financial harm. He acknowledged the $125 million fine for past sales to sophisticated third parties but criticized the SEC’s demand for $2 billion in fines as unreasonable.

Jeremy Hogan, a partner at Hogan & Hogan, explained that the injunction is unlikely to have a major impact on Ripple’s On-Demand Liquidity (ODL) sales. He noted that most of Ripple’s XRP and ODL transactions happen outside the U.S., so they aren’t affected by the ruling.

Hogan also mentioned that Ripple can still sell XRP to institutions under certain exemptions, which are easier to meet when dealing with businesses. If the SEC believes Ripple has violated the order, they would need to bring a contempt motion and provide evidence, giving Ripple a chance to defend itself.

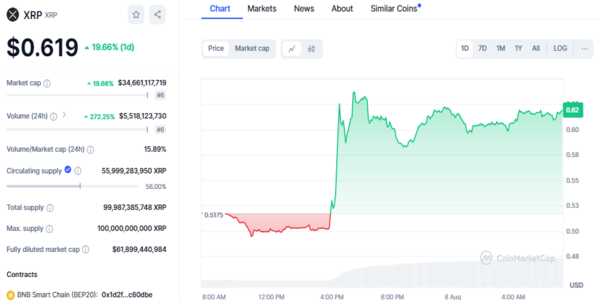

At the time of writing XRP is trading at $0.6190, XRP up over 19%. The trading volume of XRP is also over 270% which is $5.518 billion data collect from Coinmarketcap.