In this type of market, numerous depressive and unpredictable phenomena put pressure on and force XRP holders to sell their assets to avoid additional investment losses. The XRP dropped its price below the key support level of $0.05 and is now struggling to recover.

In the last 24 hours of trading, the total loss encountered by the crypto market is $367 billion. The Ripple experienced a price drop of almost 10% in the last seven days of trading and is now trading at a mark of $0.0569 according to CoinMakretCap data.

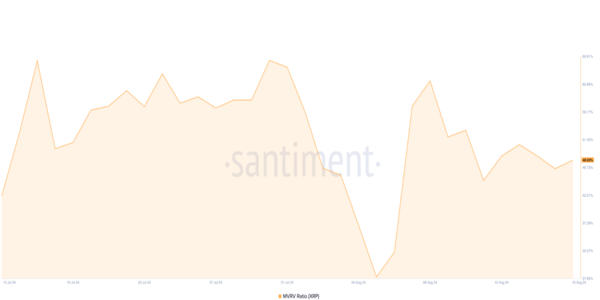

The current MVRV ratio of the asset indicates an overbought scenario and according to Sentiment data, the market value to realized value ratio of XRP is 40.

The MVRV ratio shows the amount of discrepancy between the Market value of the asset and that of its Realized value.

The value above the indicators is considered as the asset is trading above its value and the investors sell their asset to book some profit.

If the MVRV ratio is above 48, it would mean that the majority of the holders are in profit, using the current distribution of the token offerings based on the attached image.

Since the start of August, the ratio indicates that most of the traders selling their assets are in profit.

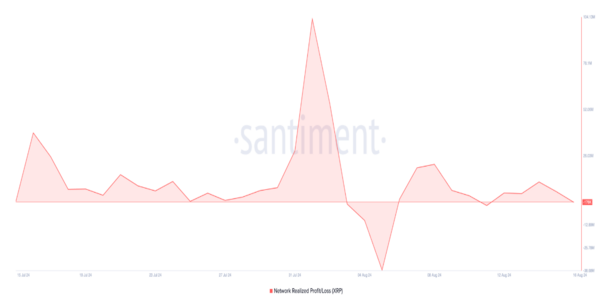

To track the overall profit and loss ratio, the PNL indicator is used, and it suggests that most of the traders are booking profit from their trades, while the dawn side in the graph shows that there are traders who are in loss from their trades.

It is a common phenomenon in the crypto market that whenever there is an increase in profit activity, it ends in dropping the price of the asset. If there is inequality in the buying and selling bids, it brings fluctuation in the price of the particular asset.

XRP price faces selling pressure

At the same time, the market of XRP seems to be rather weak, for example, the Chaikin Money Flow (CMF) is negative. Since August 11, this indicator has been below zero.

The CMF measures the flow of money in and out of the market and a negative figure implies that more money is exiting the market than entering. When this occurs in conjunction with a decrease in the price also, it means the decline might be persistent.

So if XRP is unable to attract enough new demand on the other side of the ledger to offset the ramped-up selling, then its price could well drop to $0. 52. But, if it does indeed accrue sufficient demand, the price may have to go back to $0. 60 or higher.