In a single day, the main stock exchange of Australia saw its first Bitcoin ETF trade 96,476 shares.

Australian Securities Exchange, the main stock exchange of Australia approved its first BTC ETF. This ETF with a trading volume of a total of $1.3 million this ETF on its first day of trading.

As compared to Australia the debut trading day for the U.S. states Bitcoin ETFs is higher. Across ten funds, these ETFs get a total of $4.5 billion with an average of $450 million per fund.

Although the market sizes are different these will experience the same growth as spot Bitcoin ETFs in the U.S. VanEck, the industry behind the VanEck Bitcoin ( VBTC) gave this hope to Cointelegraph.

“Notwithstanding the Australian market being a lot smaller than the U.S. and most of our flow being retail rather than institutional, there is a possibility that we may follow a similar path,”

Jamie Hannah, the deputy head of Investments and capital markets at VanEck told to Cointelegraph.

“We have had a significant amount of retail and professional investors express strong interest in getting bitcoin exposure through ASX,” he said further.

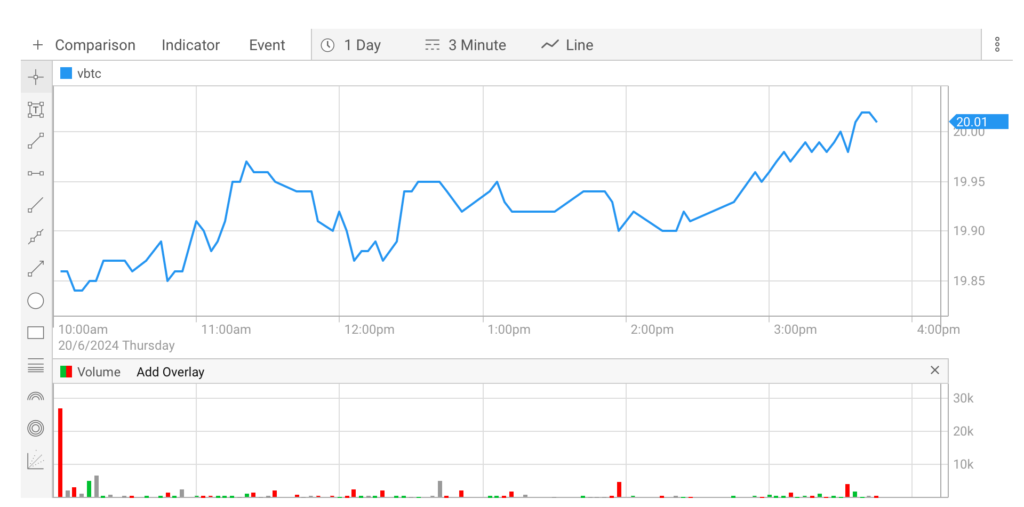

According to ASX data, VBTC was trading at $13.24 at market opening and ended trading at $13.34, with 96,476 shares changing hands intraday.

As stated by Arian Neiron, CEO of VanEck for the Asia-Pacific area, demand in Australia rising. Famous news website reported this on June 15.

Neuron stated:

“We recognize Bitcoin is an emerging asset class that many advisers and investors want to access.”

He further mentioned:

“VBTC also makes bitcoin more accessible by managing all the back-end complexity. Understanding the technical aspects of acquiring, storing, and securing digital assets is no longer necessary,”

Two more BTC exchange-traded fund (ETF) products have already been introduced in Australia, with the first one listed on ASX. The Monochrome BTC ETF (IBTC) recently got approval and started trading on Cboe Australia, the second-largest stock exchange in Australia.

The Global X21Shares Bitcoin ETF (EBTC) started trading in April 2022, marking the first ETF in Australia’s history.