The Halving event reduced the reward of miners and now the higher operational cost is not a terrible level as said by one of the crypto analysts.

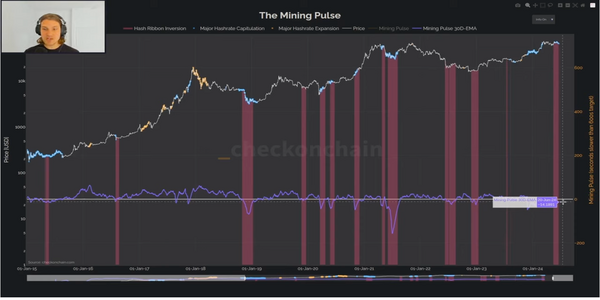

“We are in a period of hash ribbon inversion, and blocks are coming in about 14 seconds slower than they should do. hat tells you that there is less hash rate online, blocks are being found slightly slower,” Glassnode lead analyst James Check aka stated in the June 21 X video.

“About 5% of mining hashrate is struggling about the moment,” Check explained while talking about the amount of energy consumed by the mining machines to mine Bitcoin.

Check explained that 5% is not a significant portion, but the miners are selling off some of their holdings for their survival, but it is not likely to be a “complete and total firesale.”

A hash ribbon inversion happens when the 30-day moving average of the hash rate drops below the 60-day moving average, indicating a period of increased mining difficulty. This can result from various factors, such as rising operational costs, a decrease in Bitcoin’s price, or equipment problems among miners.

The recent halving event of April 20 appeared to reduce the reward of miners by half. This mechanism takes place almost every four years when miners’ reward rate declines and they start turning off the rigs that are not profitable.

This halving reduced the reward of miners from 6.25BTC to 3.125BTC.

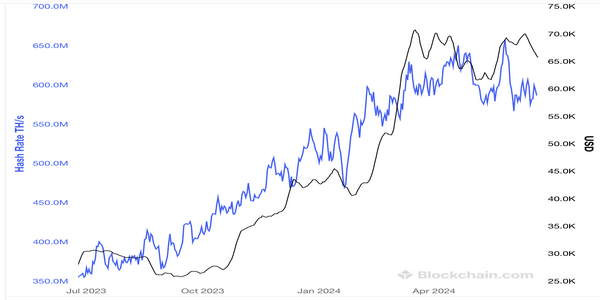

The Blockchain.com data shows that the recent BTC mining hashrate is 586 exahash per second, reduced by 2% during the last thirty days.

Check suggested that while miners might be struggling at the moment, they are likely breaking even at worst, mining new Bitcoins to cover their operational costs.

Bitcoin Miners Potentially Operating at Break-Even Point

“Miners might be treading water up here, they may not be full scale bear market level capitulating, probably just treading water, they mine ten bitcoin, they sell ten bitcoin,” Che explained after the comments of other analysts on the lack of profitability for Bitcoin miners.

“Bitcoin miners are selling most of their coins to pay the bills,” Panos posted in a June 18 X post.

The other post on X Check saw that “transaction fees represent an increasingly large proportion of miner revenues.”

He explains on X:

Miners must adapt and adjust to fees becoming their primary revenue stream, forcing the industry to further innovate, and apply efficient capital management

Nearly all Bitcoin miners are selling 100% of their coins, while CLSK is managing to Hodl their BTC & use their relatively USD balance sheet to acquire new capacity

Matthew Sigel, digital assets research head at VanEck posted on X.