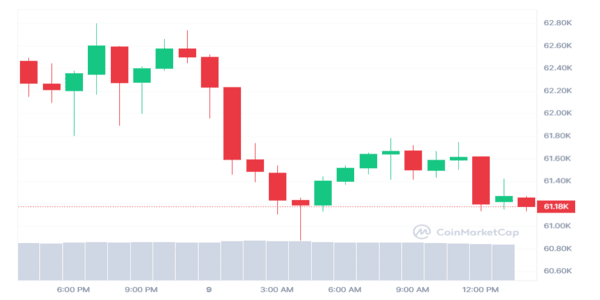

The Bitcoin BTC price is still trading above $60,000, showing a decline of 1.81% from yesterday. The network fundamentals are already showing pressure on Bitcoin as it fails to gain the expected price

On May 9, Bitcoin faced the risk of breaking down below $61,000 as familiar trend lines underwent a new test of support.

Source: Coinmarketcap

BTC Price Maintains Pressure on Bull Market Support

Data collected from Cointelegraph pro and Tradingview shows that Bitcoin is slightly losing all the gains made in the previous week.

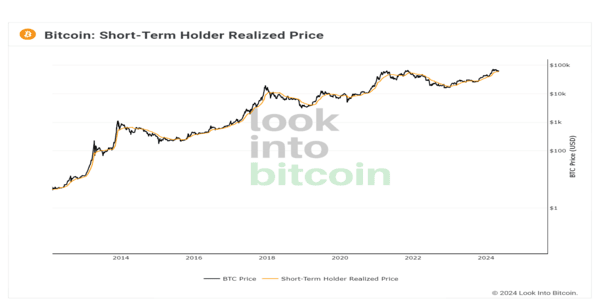

The Bitcoin price didn‘t show much growth due to volatile markets and small trading activities. Traders are now checking 100-day Simple Moving Average (SMA) and short term holders realize price once again.

A news platform stated that there are typical support levels during a bull run. The price of Bitcoin is $65,500. didn‘t hold it for long.

At the time of writing, the 100-day SMA was at $61,200, and the short-term holder realized price (STH-RP), which reflects the average purchase price of Bitcoin speculators, stood at $60,100.

Source: Look Into Bitcoin

In his recent remarks on X, well-known trader Skew emphasized the significance of the 100-day SMA and the monthly open at $60,600 on longer timeframes, which are pretty important.

“There is some 100BTC bids stacked here but need to see evidence of absorption of sellers to get strong confluence of demand,” he wrote.

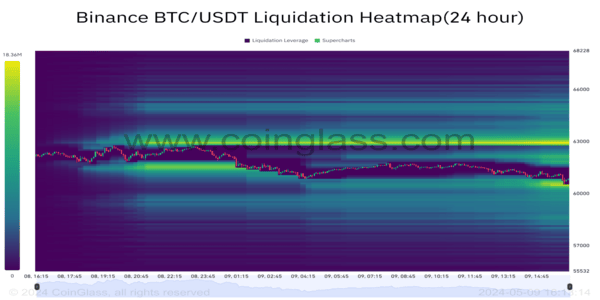

Data gathered from CoinGlass confirmed a significant amount to buy orders just below $61,000, and Bitcoin had yet to cross this level on that day.

“Clearly here someone is walking price lower while trying to draw in liquidity to sell on bounces,” Skew explained.

“Keeping an eye on this because eventually someone will take the other side (bid) & test this to ask liquidity.”

Source: Coinglass

Drop in Bitcoin Mining Hash Rate and Difficulty Levels

The recent move in the price of Bitcoin leaves a negative impact on Network fundamentals.

The data revealed by BTC.com shows a drop of 5.5% in Bitcoin mining at the time of writing. It is the largest down-trend since the bear market in 2022. At the time, BTC traded under $20,000.

Difficulty is currently at all-time highs of 83.23 trillion.

In the ongoing discussion on X, mining analysis account Pennyether pointed out that the hash rate was already declining.

“Hashrate looks to be dropping. But, what matters for miners is the difficulty, not the network hashrate. Miners will not mine more bitcoin per EH/s until difficulty gets adjusted downward, and this happens every 2016 blocks (~14d),” wrote on May 8

“Assuming we get a -7% adjustment, that puts the ‘difficulty hashrate’ at around 585 EH/s. Referring to my post-halving prediction, this is still above my estimate of 560 EH/s given the current hashprice of $50.”

Source: BTC.com