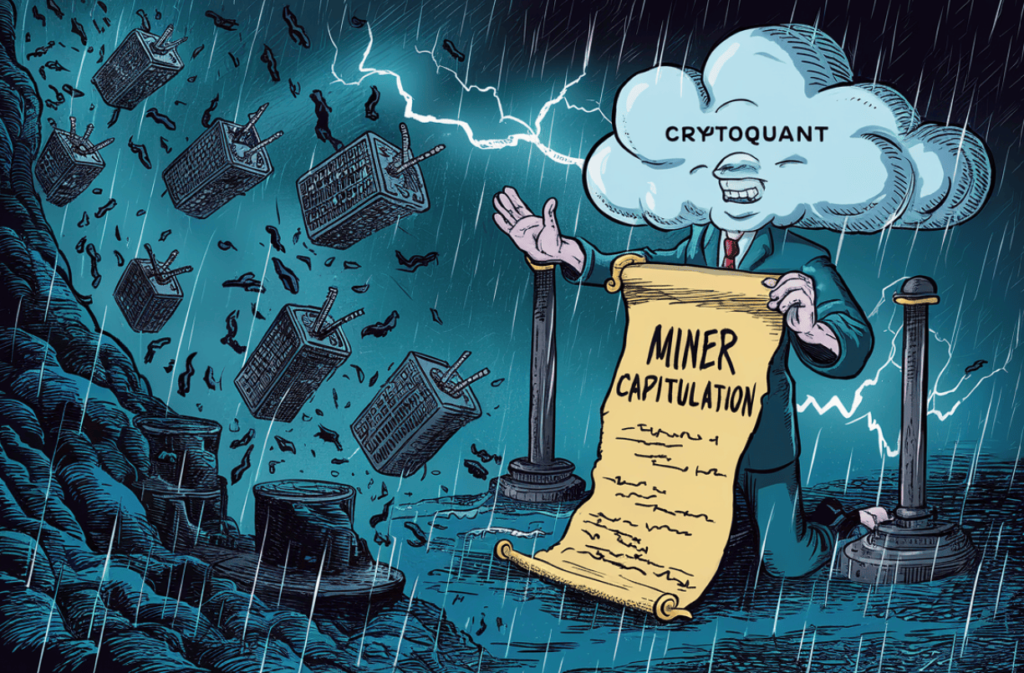

Bitcoin Miner Capitulation Signs Indicate Hasan Potential Bottom, CryptoQuant States. The historical evidence shows that the major Bitcoin price bottoms are matched with the miner capitulation characterized by halting operations or selling Bitcoin reserves due to financial pressures.

Signs of Miner Capitulation: Pred Alarms

According to the CryptoQuant report, this affirms a decline in hashrate for Bitcoin, with a 7% drop following the recent halving event to show a decline in the total computational power being used in mining.

This stands as the largest decline since December of 2022, when the FTX exchange collapsed, and the Bitcoin cycle bottom was marked by miners needing to shut down due to low profitability.

Underpayment Issues Plague Miners: Influence and Findings

Customers of CryptoQuant report that the price of Bitcoin is decreasing, and that miners’ profits have decreased because of the reduced post-halving block rewards and a decline in transaction fees that lead to underpayment. This pressure is actually forcing the miners to shutdown or sell their Bitcoin to meet their operational expenses.

According to the CryptoQuant report, by June 19, 2024, the total reserves held by Bitcoin miners had significantly decreased to 1.90 million BTC, the minimum figure since February 2010. The report also pointed towards a downtrend in miners’ Bitcoin holdings.

Namely, the profitability of mining has been declining, and as a result, miners are actively exchanging Bitcoin for other assets and withdrawing it to their wallets daily since May 21.

This trend shows that miners are selling their stocks of Bitcoin, while larger mining companies have started to use stocks for generating revenue or hedging on Bitcoin exposure, marking a new strategy due to financial concerns.

The hashprice is fundamental for miners since it determines revenue per computational power remains near all-time lows, putting significant financial pressure. Such circumstances are forcing many miners to capitulate while facing more difficulties now.

Impact of Mining Challenges on Bitcoin Prices: Highlights and Hints

The CryptoQuant report indicates that signs of miner capitulation may signal that Bitcoin is at or near a market bottom as they mark the bottom of price cycles in Bitcoin.

If miners, which can be regarded as the most bullish participants in the cryptocurrency community, are forced to sell their holdings, it can help to reduce a steep selling pressure after capitulation and possibly create the conditions for the price to stabilize and move upwards.

Analysts point to hashrate, underpayment, higher outflows, and low hashprice are flags that miners are capitulating, and this could be a turning point for the Bitcoin price.