BTC ETFs saw nearly half of asset managers increase their holdings in Q2, while 22% held steady—a solid performance, according to Bitwise’s investment chief.

Bitwise reports that about 66% of institutional investors either maintained or expanded their Bitcoin investments through U.S.-based spot ETFs during the second quarter.

SEC filings show that 44% of asset managers boosted their Bitcoin ETF positions, with 22% choosing to hold firm.

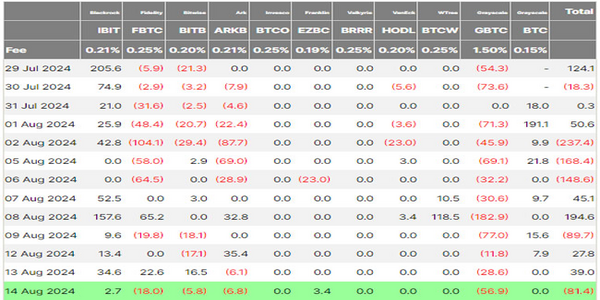

BTC ETFs saw only 21% of investors trimming their positions and just 13% exiting altogether—a result that Bitwise’s Chief Investment Officer, “Matt Hougan shared in a post on X on August 15 that the performance was comparable to other ETFs.”

The SEC Form 13F, a quarterly report required for institutional managers with at least $100 million in assets, reflects these trends.

Even with Bitcoin’s value slipping by 14.5% in Q2 2024, spot Bitcoin ETFs remained strong. Hougan added:

“Institutional investors continued to adopt Bitcoin ETFs in Q2. The trend is intact.”

Hougan noted there were 1,924 holder/ETF pairs across all ten funds, up from 1,479 in Q1—an impressive 30% increase despite falling prices in Q2.

He added that institutional investors largely held firm and didn’t panic-sell like retail investors often do during volatile times.

“If you thought institutional investors would panic at the first sign of volatility, the data suggest otherwise. They’re pretty steady.”

Hougan noted that large hedge funds such as Millennium, Schonfeld, Boothbay, and Capula were among the largest holders of ETFs. He also pointed out that advisers, family offices, and other institutional investors were actively participating.

“ETFs are a big tent that attracts a wide variety of investors. It’s kind of great to see Millennium nestled up against the State of Wisconsin in these ETF filings. Over time, I’d like to see wealth managers and pensions account for a growing share.”

In its 13F filing dated August 14, Morgan Stanley reported owning 5,500,626 shares of BlackRock’s iShares Bitcoin Trust as of June 30, 2020, which are worth $188 million. This puts Morgan Stanley among the five largest fundholders.

Similarly, Goldman Sachs also disclosed that it held in excess of $238 million invested in IBIT and other spot Bitcoin ETFs.

At the time of writing Bitcoin price is trading at $58400, its down over 4% in last 24 hours.