Monetary rate cuts from the US Federal Reserve can influence cryptocurrencies depending on received volumes of funds. Last month, Arthur Hayes, ex-CEO of BitMEX, explained why it will not boost Bitcoin adoption.

On September 02, X Hayes—now the Chief Investment Officer at Maelstrom—pointed out that even though Fed Chair Jerome Powell signaled a rate cut in September during his speech at Jackson Hole on August 23rd, Bitcoin prices have not risen as expected.

After the speech by Powell, Bitcoin rose to a high of $ 64000 and then immediately fell to $ 57400 by 2nd September dropping 10%. Making a forward journey, the coin has slightly recovered in its price by moving back to $59,053 as per the data taken from CoinMarketCap.

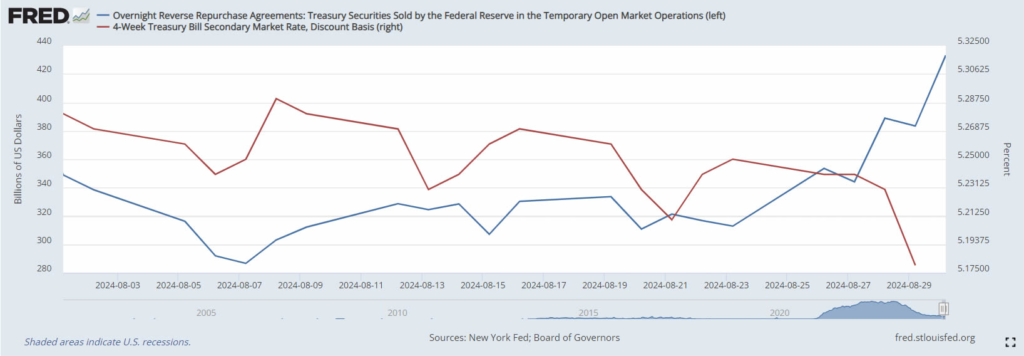

He further explained why lower rates set by the Federal Reserve aren’t helping in the bitcoin price rise. He focused on reverse repurchase agreements (RRPs), the transactions where actual securities are sold with a commitment to repurchase it, for an increased price at present giving 5. 3% interest rate.

This rate is higher than the 4 percent nominal interest rate and it creates room for increasing the interest rates to enhance economic growth. 38% yield on Treasury bills hence making RRPs even more attractive to large Money Market Funds.

Consequently, the funds end up withdrawing their cash from the Treasury bills to invest it in the RRPs, thus limiting the money they have available to invest in risk assets such as cryptocurrencies, according to Hayes. The X account “ELI5 of TLDR” further explained that the RRP program serves as the big bank’s and money managers’ ’parking lot’ because it provides better yield than other risk-free investments.

This situation means that the circulation of capital in the economy is low, hence a low circulation of capital in the economy. Hayes said $120 billion has been stashed in RRPs since the Fed indicated in July that it might cut the rate in September.

Hayes then said that this pushes the notion that low interest rates help high-risk investments such as Bitcoin into question. Some believe that low rates lead to greater borrowing and spending, make cash dear and market more liquid, cause the non-interest-bearing dollar less attractive, and much more.

Turn to the CME Fed Watch tool and you will see a 69% probability of a 25 bp reduction and 31% probability of a 50 bp cut at the meeting held on September 18.

A higher rate of interest rate cut would signal stronger action by the Fed and might have a stronger response in the market and, thereby, potentially provide a bigger stimulus to the economy.