Bitcoin’s price fell 1.4% to $63,721 on Thursday after the US Federal Reserve kept interest rates steady amid rising Middle East tensions and XRP slips as market dips.

This drop below $65,000, the first in a week, came after Fed officials held rates at 5.3% during their July meeting. They hinted that the recent progress in reducing inflation might allow for future rate cuts.

Fed Chair Jerome Powell stated that a rate cut “could be on the table” at the next meeting on September 18.

Bitcoin Fluctuates as Fed Shifts Focus

The central bank’s statement on Wednesday is boosting hopes for a future rate cut. Officials pointed out that inflation is slowing down and are now paying more attention to the job market.

“The economic outlook is uncertain, and the committee is mindful of risks on both sides of its mandate,” the statement said. This replaces their earlier focus on being “highly attentive to inflation risks.”

Fed decisions often affect Bitcoin markets. Traders react to expected rate changes, causing Bitcoin and other cryptocurrencies to fluctuate in price.

XRP Slips as Market Dips, Ether and SOL Also Down

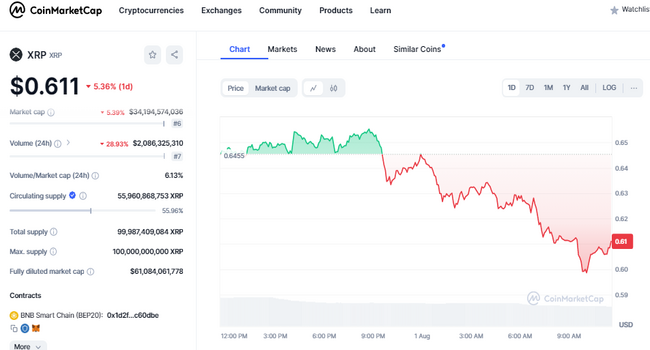

XRP dropped nearly 5.36% to $0.611, wiping out gains from July 31.

On Wednesday, XRP’s price rise was linked to its wealthiest holders, known as “whales,” accumulating more. This pattern looked similar to pre-2017 rallies, suggesting potential for more growth in the coming months.

Data from Santiment showed an increase in XRP holdings among addresses with at least 10,000 tokens.

Meanwhile, Ether fell 4.24% to $3,178, and Solana’s SOL decreased by 7.37%, in the last 24-hours