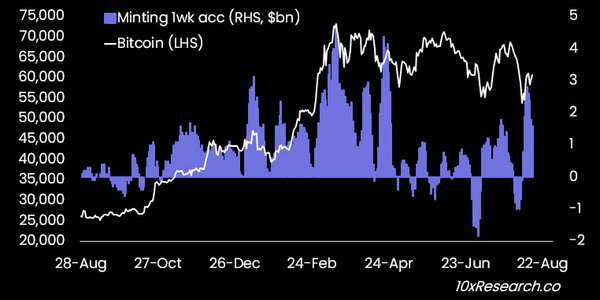

Tether and Circle have issued over $2.5 billion over the past week, and 10x Research thinks this growing trend could ignite a Bitcoin next rally.

Markus Thielen, a market researcher at 10x, believes that the rise in stablecoin issuance might be the trigger for Bitcoin’s next big surge.

Last week, Tether and Circle issued nearly $2.8 billion, suggesting that institutional investors are putting fresh money into the crypto market, according to the head researcher at 10x Research on Aug. 14.

He also mentioned that if this trend in stablecoin issuance keeps up, it could push Bitcoin price higher.

“If this trend of issuance (not just minting) continues, Bitcoin could see further gains.”

Since August 9, Bitcoin has been fluctuating between $58,000 and $62,000 after recovering from a drop to $55,000.

However, breaking through the $60,000 to $61,000 resistance level will need more than just a lower Consumer Price Index (CPI), he pointed out.

Bitcoin next rally and stablecoin trends

With the July CPI report, a key indicator of U.S. inflation, expected on August 14, he mentioned that a lasting rally will likely require “real money buying through stablecoins.”

“A strong stablecoin inflow is essential to make the breakout sustainable, especially since other factors have had less impact on Bitcoin’s rally this year.”

The researcher mentioned that Bitcoin’s price action “looks promising” if it stays above $60,000, but warned that without stronger stablecoin inflows, the rally might lose steam.

On August 13, Tether minted $1 billion in USDT, but CEO Paulo Ardoino clarified that it was for inventory building, not immediate issuance.

Tether’s market capitalization has grown by about a billion dollars in the past week, reaching a record $115.6 billion, according to their transparency report. Meanwhile, Circle’s market cap has risen by 4.5% since early August, with $34.5 billion in USDC now in circulation.

“Given Circle’s ties to more regulated counterparties than Tether, these flows likely originated from U.S. institutions capitalizing on the dip,” noted Thielen.

He concluded that without other factors like changes in the broader economy, a more supportive Federal Reserve, or Donald Trump gaining traction in the polls, “Bitcoin will likely stay sluggish in the short term.”

Bitcoin prices have risen over 2.50% in the last 24 hours, reaching near $61,000 in early trading on August 14.