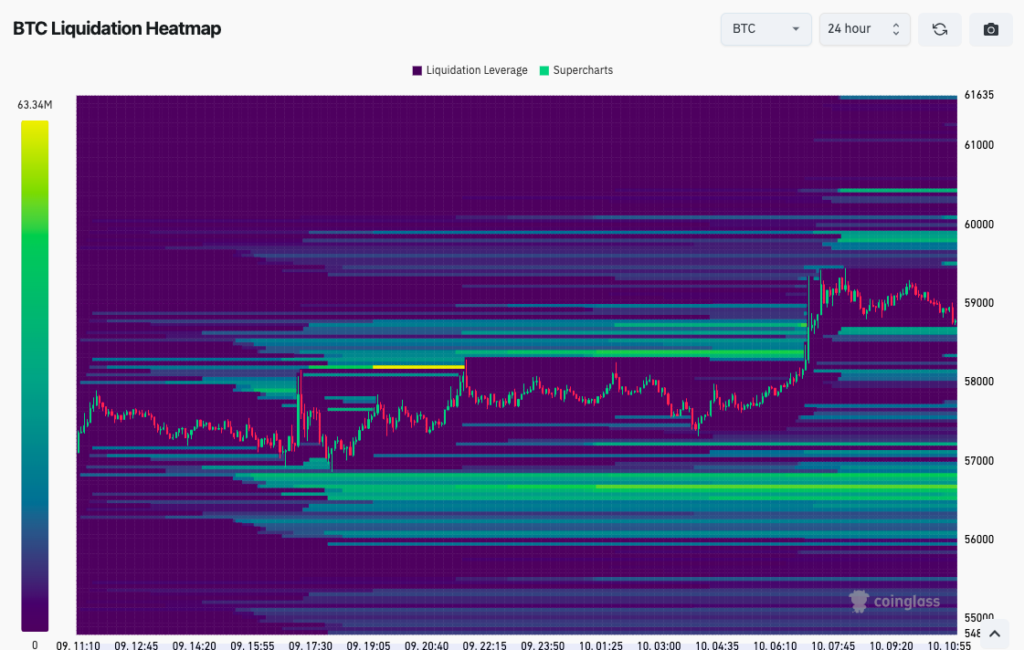

The BTC price is gaining momentum, but there’s a lot of trading activity at $60,000 to stop the market from recovering.

On July 10, Bitcoin (BTC) approached $60,000 as buyers tried to maintain important support levels.

BTC Price RSI Shows Classic Rebound

Data from TradingView showed that BTC hit a high of $59,459 on Bitstamp today.

Rise in the Asia trading session also inflated the general value of BTC/USD by 1. 5% at the time of writing; the pair has recovered from the classic “oversold” conditions.

Many market participants had talked about these conditions, especially the relative strength index (RSI), which had hit its lowest level in ten months.

On July 9, popular trader Daan Crypto Trades posted on X (formerly Twitter). “Bullish divergences on the daily confirmed,”

“Be on the look out for an overall high timeframe break out on the daily RSI at some point in the future.”

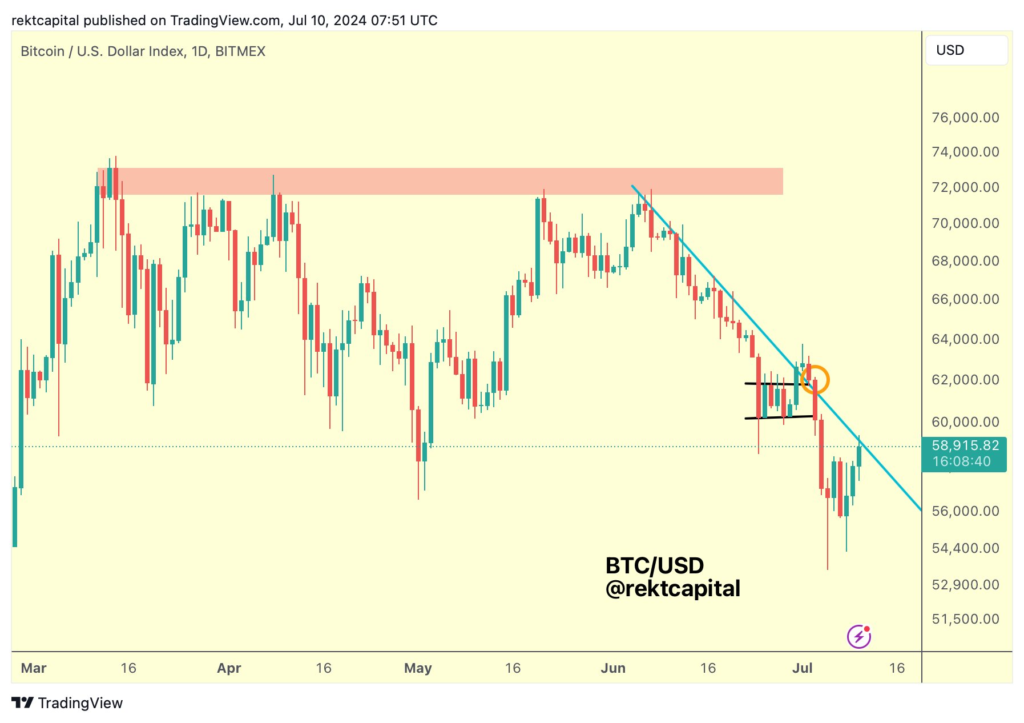

Popular trader and analyst Rekt Capital said the RSI divergence was “playing out.”

Daan Crypto Trades highlighted $59,000 as the key price level to reclaim, while others pointed to $58,400 as an important level to watch in the effort to break through the $60,000 resistance.

“If $BTC can reclaim $58,400, a $60,000–$60,700 retest is likely,” predicted by trader Justin Bennett.

“What happens between $60k and $58,400 will determine whether Bitcoin sees $67k or $48k next.”

Bennett emphasized that upcoming U.S. economic reports, like the Consumer Price Index (CPI) and Producer Price Index (PPI), would be crucial for Bitcoin’s market performance.

Bitcoin Bears Face Final Resistance

The latest data from CoinGlass, a monitoring resource, showed that liquidity at that important level was low but increasing at the time of writing. Most of the trades happened as the market pushed higher during the day.

“Bitcoin is now challenging the 1.5-month Downtrend for a breakout attempt,” Rekt Capital continued.

Currently, Bitcoin’s price action involves a struggle around both the 100-day and 200-day moving averages (MAs), with BTC/USD currently caught between them.