BlackRock Bitcoin exchange-traded fund, launched in January, records a second major outflow of $14.5 million, caused by the significant drop in Bitcoin price at $59K.

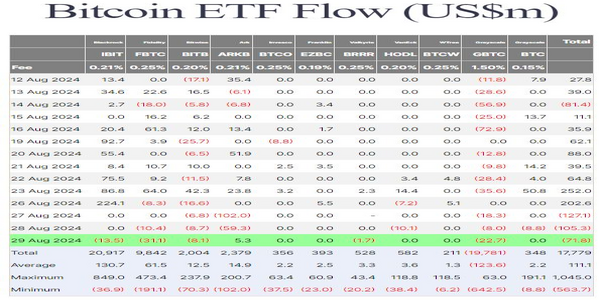

On August 29, iShares Bitcoin Exchange TradedFunds encountered an outflow of $13.5 million. This is the second time this ETF has seen an outflow. The first outflow was recorded on May 1, totaling $36.9 million. This combined outflow is considered one of the worst outflows ever recorded, which calculated a total of $563.7 million as per the Farside Investor data.

In the single day to August 29, all the 11 Bitcoin ETFs operating in the United States experienced a net outflow of $71. 8 million.

FBTC, a fund managed by Fidelity, recorded the largest outflow of $31 and was followed by BlackRock Bitcoin fund which recorded an outflow of $30. 1 million and Bitcoin investors via the Grayscale Bitcoin Trust (GBTC), which lost $22.7M

IBIT outflow day takes place after a gross inflow credited at $224. 1 million on August 26 its highest trading volume since July 22 with $526. 7 million in inflows.

Cathie Wood’s ARK 21Shares Bitcoin ETF was the only fund to report fresh net investments on August 29 with $5. 3 million added.

Such Bitcoin ETF outflows are taking place at a worse time as the price of Bitcoins has declined by about 2.89% in the last week and is now at $59,339 as per the data provided by CoinMarketCap.

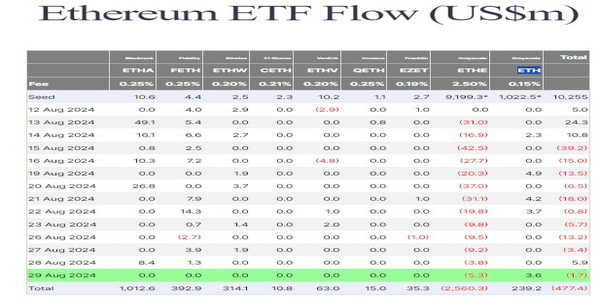

At the same time, the US-based spot Ether ETFs saw mere combined outflows of $1. 7 million on August 29, with many funds showing NO movements at all.

Grayscale Ethereum Mini Trust (ETH) was the only ETF to receive a net inflow of $3. 6 million which of course, was not enough to counter the $5. 3 million compared with 3.03 million in outflows from its more costly sibling, the Grayscale Ethereum Trust (ETHE).

Since July, the assets under management of Grayscale’s Ethereum Trust have experienced net redemptions almost every single day, amounting to $2. 56 billion.

At the same time, the ETH price showed a downside as well, and it continued to decline to $2518 down by 5.69% over the past week according to CoinMarketCap data