BlackRock ETF experienced a massive inflow and reached a record level in the last 35 days since July 22, as buyers are taking advantage of the Bitcoin price drop, which slipped to $64K after a weekly rally.

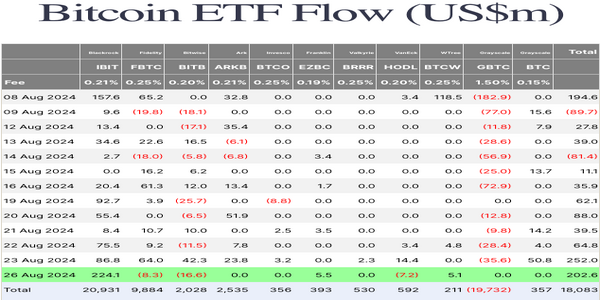

According to Farside Investor data, the iShares Bitcoin Trust ETF recorded a net inflow of $224.1 million on August 26, the largest since July 22, when the asset had $526.7M in inflows. At that time, Bitcoin Rally spiked and hit the figure of $67,534.

In the past 24 hours of trading, Bitcoin slipped almost 2.8% and is trading at a $62,790 mark. This happened after a strong trending wave took Bitcoin from the 7-day low of $58,756 to a pike point of $64,475 on Aug. 25. This is the pike of BTC price in August.

IBIT’s inflows led to the 11 U.S. spot Bitcoin ETFs recording their highest daily combined net inflows of $202. 6 million. At the same time, outflows in funds from issuers, such as Bitwise, Fidelity, and VanEck reached negative $32. 1 million.

They were the only other ETFs to record net inflows, with Franklin Bitcoin ETF (EZBC) experiencing $5.5 million and $5.1 million, respectively.

The iShares Bitcoin Trust ETF also sees a massive inflow, which leads in global crypto investment products in the week of August 23. Even, CoinShares reported that these products witnessed the highest inflows in a week in the last five weeks.

Investment products linked to Bitcoin saw the biggest inflows last week with $543 million and IBIT taking a lion’s share of $318 million.

Specifically, Butterfill said that last week’s increase in Crypto product purchases was driven by the expectation of a decrease in the US Federal fund rates following Federal Funds Reference Rate Committee Chair, Jerome Powell’s wink at a potential rate cut in September this year.