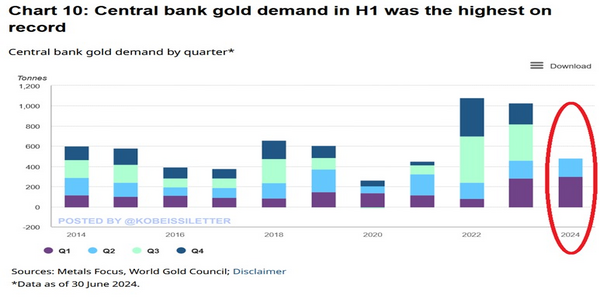

To store valuable assets, central banks worldwide are increasing their gold reserves to a record level in 2024. The total gold acquired by the Central Bank reached a record level of 483 tonnes in the first quarter of this year.

According to the macroeconomics outlet post on X on Sept. 2, the Kobeissi Letter revealed that the net purchase of gold in the first two quarters of 2024 reached 483 metric tons, the highest purchasing until now.

According to the report, this roughly translates to 5% of the previous record of 460 tonnes, which was recorded in the first half of 2023. In Q2 2024, the central banks bought 183 tonnes of gold which is 6% higher than in the same three months of the previous year.

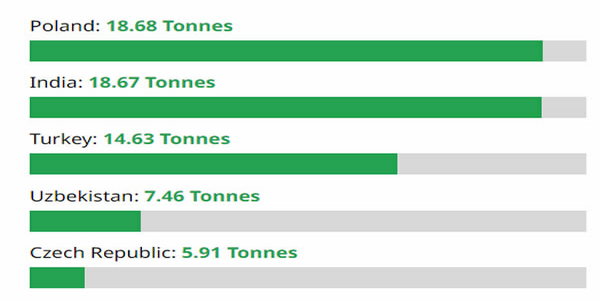

The major buyers during this period include the National Bank, the Reserve Bank of India, and the Central Bank of Turkey.

At the end of August, the president of the National Bank of Poland, Adam Glapinski, said that the bank aims to further accumulate gold as part of foreign exchange reserves and wants to increase it to 20 percent.

In an interview with Tolou Capital Management founder Spencer Hakimian, he said that China, India, Russia, and Saudi Arabia ‘no longer trust holding western reserve assets.’ The only reserve asset in the present global scenario that is neutral and stable is gold, said Hakimian.

Bitcoin outshines Gold reserve

Compared to Gold, the Return on Investment provided by Bitcoin remained at 37% this year and declined by almost 22% after hitting its all-time high.

Despite this, gold advocate and crypto skeptic Peter Schiff said regarding X on September 1 that while Bitcoin has only risen in the first two months of the year, gold has gone up since the beginning of the year even though US spot ETFs have been launched.

Gold went for $2,525 per ounce at its highest point on August 27. Schiff said that “the trend has reversed itself, “ However, BTC has continued to perform better than gold for this year. As for now, central banks remain somewhat conservative towards this relative newcomer in the assets list.