CoinShares predicts that crypto investment products will be more affected by changes in interest rates this September.

Recently, after enjoying a period of strong inflows, cryptocurrency investment products are now experiencing significant outflows due to positive economic news from the United States.

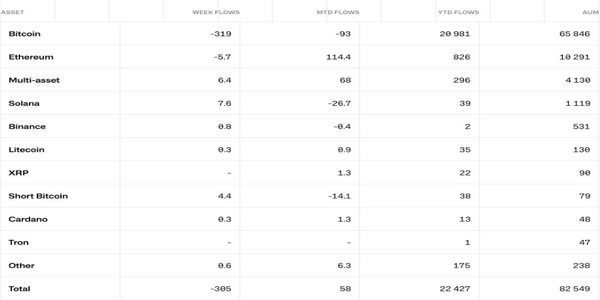

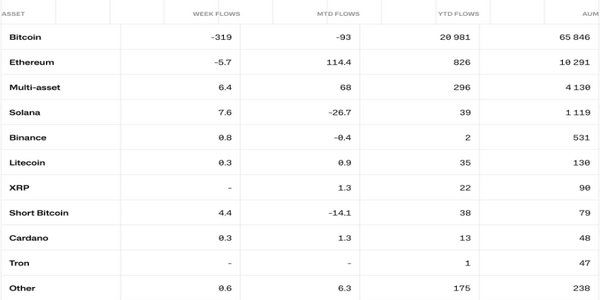

According to CoinShares’ latest report on digital asset fund flows published on September 2, digital asset investment products saw outflows of $305 million last week, driven by unexpectedly strong economic data from the US.

The report shows that from August 24 to August 31, investors in the US sold the most crypto investment products, with outflows reaching $318 million.

Meanwhile, Germany and Sweden had smaller outflows of $7.3 million and $4.3 million, respectively. On the bright side, Switzerland and Canada saw small inflows of $5.5 million and $13.2 million, respectively.

Markets eye rate cuts as inflation creeps up

The US Commerce Department reported on August 30 that the Personal Consumption Expenditures (PCE) price index went up by 0.2% from the previous month and by 2.5% compared to the same time last year.

Since consumer spending drives economic growth in the US, the PCE is one of the US Federal Reserve’s favorite measures of inflation. It’s expected that the Fed will make its first interest rate cut in over four years.

This report was released as markets were expecting rate cuts in September, suggesting a 24 basis point reduction and lowering the chance of a 50 basis point cut.

CoinShares noted in its latest report, “We believe that crypto investments will react more strongly to interest rate expectations as the Fed gets closer to changing its course.”

CoinShares’ latest report shows that Bitcoin investment products faced the biggest losses last week, with $319 million in outflows.

On the flip side, short Bitcoin investment products had their second week in a row of inflows, totaling $4.4 million—the largest since March 2024.

Ethereum investment products also saw $5.7 million in outflows, continuing their downward trend even after the launch of Ethereum ETFs in the US on July 23, 2024.

Interestingly, blockchain-related stocks went against the trend, with $11 million in inflows, especially in Bitcoin miner-focused investment products, as noted in the report.