As it is pointed from the latest Quarterly Report made by CoinMarketCap, three main factors out of which two are associated with the US, will impact on the price of Bitcoin (BTC) in the last quarter of the year.

First, the report discusses certain macroeconomic factors. Its is evident that many people are closely looking into the American Federal Reserve in relation to interest rates.

However, this report also provides for others larger economic factors such as; productivity unemployment and inflation. If indicators of a recession appear, price downtrend becomes a possibility for Bitcoin, as investors tend to minimize risk exposure.

According to the report, it mentions that, “If the US is probably on course for a recession, then it will be difficult for Bitcoin to host a sustainable bull run.”

The second influential factor is political influence.

The researchers note that guidance on the US concerning cryptocurrencies is important. Some even stated that positive regulations shall contribute to Bitcoins’ price increase while negative view or stricter rules shall depress the excitement.

The third dimension is institutional investment. The mobilisation of money into Bitcoin ETFs and the overall crypto market demonstrates how much faith investors have.

The report went on to say, “Large institutional investments could significantly propel BTC prices up further potentially increasing the Q4 rally considerably.”

Q3 Crypto dip: Will Bitcoin surge to New Highs in Q4?

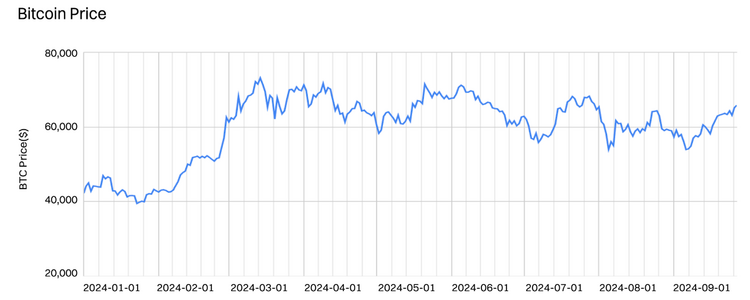

The Crypto market in Q3 of the year 2024 was slightly bearish which is common with such markets during this period of the year.

There were various causalities for this decline including macroeconomic factors, and government wallet flips, FTX liquidations, meme coin sector collapse, US Federal Reserve rate decisions, and more.

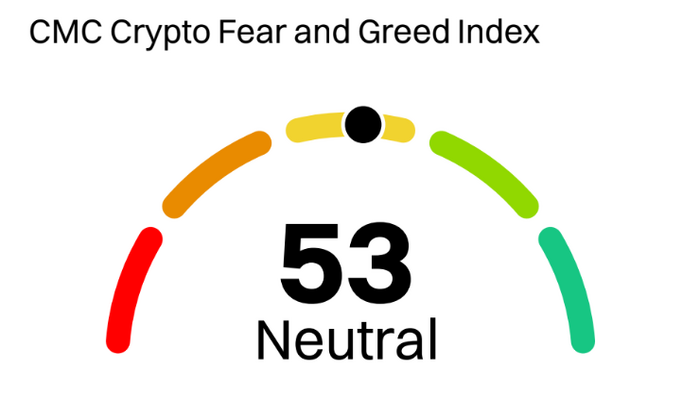

Market mood remained bearish and Bitcoin flipped the $50,000 range with the Crypto Fear & Greed index reflecting 30-40 marks, which means that the market remained hesitant. The number, which can be between 0 and 100, stands for fear on the low end, and greed on the other end. At the recent time of the preparation of this report it was again increased at 53 indicating the neutral country on the part of.

But the fourth quarter looks more promising considering recent fluctuations as mining stocks have often shown. Some researchers expect that forthcoming US presidential elections in November will decrease uncertainty.

In its last decade, Bitcoin shows the strongest performance in Q4 with an average increase in the price by 90.33%. Starting this Q4 at a relatively low price point Bitcoin could reach a new record high by year end.

With these factors in mind the report says that it is very likely that price for Bitcoin may go up before the year ends and touch a new high again.

#Bitcoin News #Bitcoin Price #Bitcoin ATH