Bitcoin price movement, which includes its all-time high in March shows some relation with the Federal Reserve’s Security.

The United States economic conditions are becoming favorable for Bitcoin’s price to start rising again in approximately 10 days.

Tedtalksmacro, a financial commentator finds some relation between Bitcoin price volatility and U.S. Federal Reserve liquidity.

Bitcoin price remained at 3.2% down in June, but the upcoming FED liquidity rice may turn the table before the month’s end.

“The correlation between Bitcoin + Fed Liquidity never ceases to amaze me,” Tedtalksmacro posted on X.

“Liquidity bottoms in the coming 10 days, then rips higher again… get ready.”

According to a chart from his exclusive macro data source, Talking Macro, Bitcoin’s price highs, and lows align with peaks and troughs in Federal Reserve liquidity.

The all-time high of Bitcoin in March was the outcome of a liquidity spike in the U.S.

While learning how liquidity is calculated, Tedtalksmacro explained that the figures are based on “a mixture of Fed assets, repo markets, treasury data.”

Impact of U.S. Wirehouses on Bitcoin ETFs Expected Soon

Talking Macro highlighted challenging short-term obstacles for Bitcoin, citing a recent decrease in inflows to U.S. spot Bitcoin exchange-traded funds (ETFs).

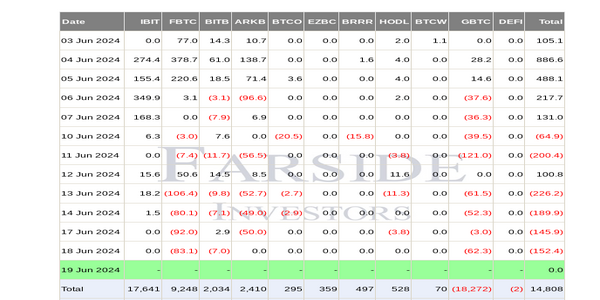

After experiencing their second-highest daily amount of money coming in during early June, the situation changed, and over the last four trading days, there has been more money leaving than entering.

Data from monitoring resources revealed that the outflow of a United Kingdom-based firm, Farside Investors is over $700 million, this figure is still less than the June 4 $886 million inflow.

People are excited for the third quarter and beyond as they expect a new wave of institutional interest in Bitcoin. U.S. wirehouses are predicted to gain access to spot ETF products soon.

“No platform has approved Bitcoin yet, so all of this price action has happened before they approve it, and so we haven’t even begun,” Cathie Wood, CEO of asset manager ARK Invest said in an interview about U.S. wirehouses.