Bitcoin holders are facing mounting unrealized losses, but unlike in past market cycles, those who are losing money are staying calm.

Long-term Bitcoin holders are not selling during the current price cycle’s “deepest correction.”

In its latest weekly newsletter, The Week Onchain, crypto analytics firm Glassnode shared positive news about the resilience of Bitcoin holders

Glassnode Applauds Bitcoin Market Resilience

Bitcoin might be going through its biggest drop of the current bull market, but its “diamond hands” holders aren’t panicking.

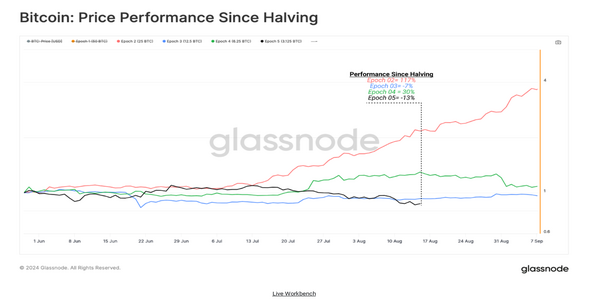

For Glassnode, “if we look at performance indexed to the date of the Bitcoin halving, we can see that the current cycle is one of the worst performing.”

“This is despite the market breaching to a new cyclical ATH prior to the halving event in April, which was the first time this has happened,” it summarized.

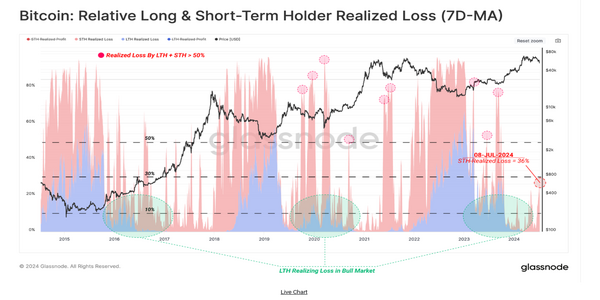

Unlike previous big sell-offs in Bitcoin’s recent history, Glassnode shows that long-term holders are holding on to their BTC. Even when BTC/USD recently dropped to a four-month low of $53,500, they didn’t lose their nerve.

“Looking at losses locked in by both Long-Term, and Short-Term Holders, we note that the loss taking events this week account for less than 36% of the total capital flows across the Bitcoin network,” The newsletter has verified this.

“Major capitulation events, such as Sep 2019, March 2020, and the sell-off in May 2021, saw losses account for more than 60% of capital flows over a period of several weeks, with a meaningful contribution from both cohorts.”

Long-term holders are Bitcoin wallets that have held BTC for over 155 days, while short-term holders have held for less than 155 days. Short-term holders tend to be more speculative investors.

Glassnode shared a chart showing that long-term holders weren’t selling their BTC at a loss during the recent price drop.

“Following 18 months of up-only price action after the FTX implosion, and 3 months of apathetic sideways trading, the market has endured its deepest correction of the cycle,” it mentioned in its final thoughts.

“Nevertheless, drawdowns across our current cycle remains favourable when compared to historical cycles suggesting a relatively robust underlying market structure.”

When Will The BTC Price Turnaround?

According to a popular website, the attention is on short-term holders and day traders, as they face negative profit margins.

At the recent low of $53,500, Glassnode noted that short-term holders held almost 2.8 million BTC, which is about 14.2% of the total supply, at a loss that hasn’t been realized yet.

Miners are also causing concern, as the hashrate continues to drop, reminding seasoned market watchers of the events before the bear market hit its lowest point in late 2022.

Charles Edwards, founder of Capriole Investments, a fund focusing on Bitcoin and digital assets, cautioned his followers on X (formerly Twitter) on July 10.

During the discussions that followed, Edwards hinted that a buy signal might still be “at least a couple of weeks away.”