The Consumer Price Index is a critical indicator for Bitcoin which has the potential to shift its price to an all-time high, according to crypto analysts.

According to an analyst, before beating its all-time high, Bitcoin needs United States inflation to slow down as the results of inflations are due in the next month.

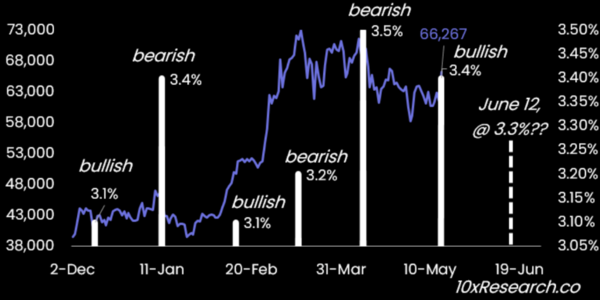

“If inflation prints 3.3% or lower, Bitcoin should make a new all-time high,” Markus Thielen, 10X research head stated in a report on May 29, ahead of the U.S. Bureau of Labor Statistics (BLS) releasing the Consumer Price Index (CPI) results on June 12.

The previous CPI inflation released by the authorities was 3.4% on May 15. A 0.1% decrease can make BTC set a new milestone. Thielen believes that before the declaration of CPI results, in these two weeks, the inflow of funds in spot Bitcoin ETF will remain strong.

If the CPI results are not as expected, The price of BTC may fall as witnessed at the beginning of this year.

Since May 13, in the last two weeks, Farside data reveals that the cash inflow in spot Bitcoin ETF remains positive day-on-day. A massive rally of funds inflow was witnessed on May 21 at $305.7 million.

Thielen argued that Bitcoin’s price doesn’t move randomly; it is influenced by key factors, with inflation being the main driver.

Several times this year, Bitcoin’s price has dropped after higher-than-expected CPI results.

The price of Bitcoin dropped by 6.67% to $56,000, after a few days when the CPI results were printed on April 10.

Thielen stated that after the successful launch of spot Bitcoin ETFs on Jan 11, a major inflow of $611 million shocked the world, but after that, the results of the inflow in BTC ETFs were disappointing.

For this disappointment, he blamed the CPI results, which were more than expected. Thielen said:

The CPI came in at 3.4%, higher than the 3.2% expected number and higher than the 3.1% recorded in the previous month.

It is no coincidence that Bitcoin was weak in January and stronger into March but consolidated for two months”