When there were fewer Bitcoins for sale on trading platforms, large Bitcoin buyers rapidly acquired enough Bitcoins.

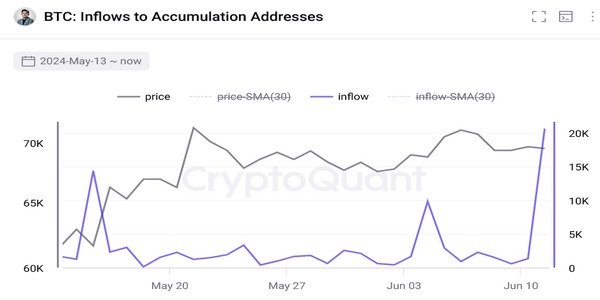

Large Bitcoin purchasers preyed on the June 1 decline in price by buying 20,600 BTC together, which came in at $1.38 billion.

According to CryptoQuant, a blockchain data analysis business, it was the largest day for large Bitcoin buyers since February 28. At that time, exchange-traded funds (ETFs) for Bitcoin were only getting started. The price of Bitcoin was almost at its peak.

Bitcoin whales were receiving between 1300 and 2200 bitcoin daily, even though the price of Bitcoin had fallen from $71,650 on June 7 to approximately $69,000. After that, the price fell even further in the next few days. On June 11th, whale accounts received a massive 20,600 Bitcoin boost.

The data for June 12 still needs to be updated. That day, the US Consumer Price Index findings exceeded expectations, which caused the price of Bitcoin to rise sharply for a brief period. At the time of writing the article, the price of Bitcoin was $67,500.

Source: CryptoQuant

This occurred as a result of the decline to 942,000 Bitcoin available on crypto exchanges. This is the lowest it’s been since December 22, 2021, as per the data tracked by Santiment.com.

A decline in Bitcoin reserves indicates a strengthening of the market. Investors think the price will rise in the mid- to long run.

CoinGecko reports that the price of Bitcoin is now 8.45% less than its all-time high of $73,737 on March 13.

Ethereum whales are also active

Large Ethereum purchasers have lately bought over 240000 Ether. In today’s currency, this sum is almost worth $840 million. Ali Martinez, an industry analyst, provided this information after obtaining the sensitive data.

Source: Ali Martinez

Santiment notes that, in contrast to Bitcoin, there has been a recent increase in the quantity of Ether available on crypto exchanges.

According to Santiment, there are now 17.98 million ETH stored on various exchanges, valued at $63.1 billion. Ether is now trading for $3,510, down 8% from $3,815 on June 7.