Veteran trader Peter Brandt gave birth to a new argument, suggesting that BTC hit its peak in this cycle. Although he never provides enough details in his theory, this prediction conflicts with his theory about Bitcoin’s price.

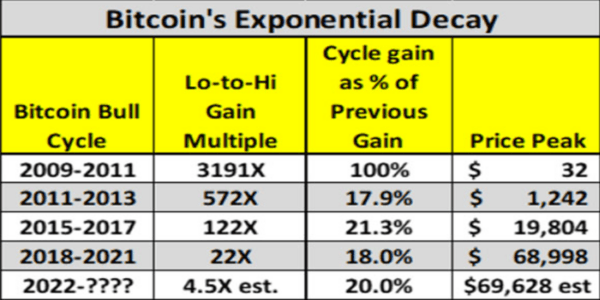

According to the “exponential decay” pattern prepared by Peter Brandt, there are very few chances that Bitcoin will hit its peak in this cycle by touching the mark of $70,000.

Many other Price analysts and predictors do not agree with Bradt and state that BTC is far away from its peak. At the time of writing, BTC is trading at the price of $62,405, and as per the prediction, it can reach up to $210,000 before the end of this Bull run.

In his recent analysis on April 27, Bradt posted that the Bitcoin Bull run cycle exposes an “exponential decay” pattern

This pattern occurs when each cycle has a peak price of 20% of the previous cycle’s gain. The data below will show that this has already happened in the case of Bitcoin.

“Worded another way, 80% of the exponential energy of each successful bull market cycle has been lost,” Brandt stated.

Source: Peter Bradt

According to this chart, Bradt predicts that the maximum gain in BTC price can be 4.5x the gain from the low of $25,500. The top projected according to this is $70,000, which BTC achieves in the month of March by hitting $73,000.

Bradit, himself is not fully convinced with this theory, however, analyzing 25% chances of Bitcoin has already hit its peak.

Bitcoin’s Price Analysis: Insights from Santostasi and Other Analysts

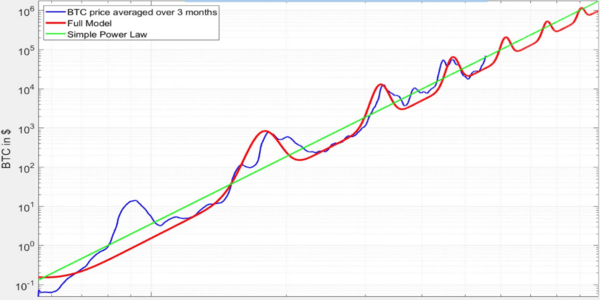

On April 29, Giovanni Santostasi, who is the CEO and research director at Quantonomy, disagreed with the idea that Bitcoin price can drop very quickly over time. Instead. He suggested his own theory based on long-term patterns.

Answering to Brandt’s theory, he said, “We have only 3 data points if we exclude the pre-halving period and actually only 2 data points if we consider the ratios,” before adding, “This is hardly enough data to do any significant statistical analysis.”

Santostasi looked at how much the price trend was different from the usual trend over time. Then, he suggested a different pattern where the price declines more slowly.

The power law is a way to show how the change in one thing varies from another. In BTC it is how price changes over time.

By using these features extracted from the genesis block, the BTC price is predicted to reach $120,000 during its fourth peak in December 2025. Based on historical observation, the bottom of BTC for the next cycle is $83,000, he said.

Source: Giovanni Santostasi

Santostasi combines multiple elements like the power law trend, halving cycles, decreasing peak heights, and other factors to form a complete model for Bitcoin price prediction.

Analysts like Pav Hundal, the lead analystSwiftx,iftx give his prediction on Bitcoin price. While talking to Cointelegraph, he stated that the price of this token will increase to 2x before 2028. He gave a prediction of $120,000 for Bitcoin.

Laurent Benayoun, who is the CEO of Acheron Trading and Quantitative, predicts the price to be at $180,000 during this bull run.