The latest updates from Australian news highlight the increasing crypto crime . Tough regulations are required to overcome these criminal activities, money laundering, and other related services.

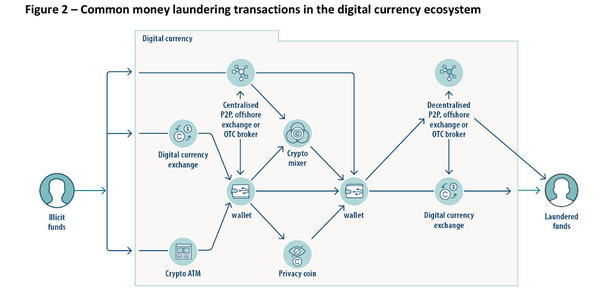

A government financial intelligence agency, the Australian Transaction Reports and Analysis Centre (AUSTRAC), provided an updated report on the illegal use of cryptocurrency, unregistered remittances, and other services in their money laundering report.

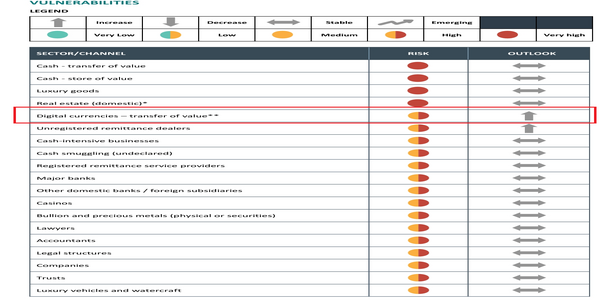

Despite globalization, people use traditional sources to launder money through luxury goods, cash, and real estate.

As indicated above, traditional financial channels were a “very high” risk factor, whereas digital currencies received a comparatively lower risk factor. However, AUSTRAC expects a rise in the criminal use of cryptocurrencies due to their greater anonymity and faster transaction speeds.

“Criminal use of digital currency, digital currency exchanges, unregistered remitters, and bullion dealers is increasing.”

Criminals Capitalize on Crypto’s Speed and Anonymity

To overcome the increasing crypto scams and anti-money laundering issues Austarilia directed all crypto exchanges to get themselves registered on AUSTRAC under the AML/CTF Act.

Recently Australia banned for using crypto and credit cards for online gambling. The authorities cautioned the exchanges that in case of not getting registered on AUSTRAC, fines up to $234,750 can be charged to them.

the CEO of Responsible Wagering Australia, Kai Cantwell stated that it is a good step taken by the authorities to keep people away from scammers.

“This is an important measure to protect customers, making it easier for people to stay in control of their own gambling behavior,” he added.