Bitcoin had its fifth-largest week of crypto inflows ever, pushing its price back above $60,000. Ether came in second, boosted by excitement over upcoming US Ether ETFs.

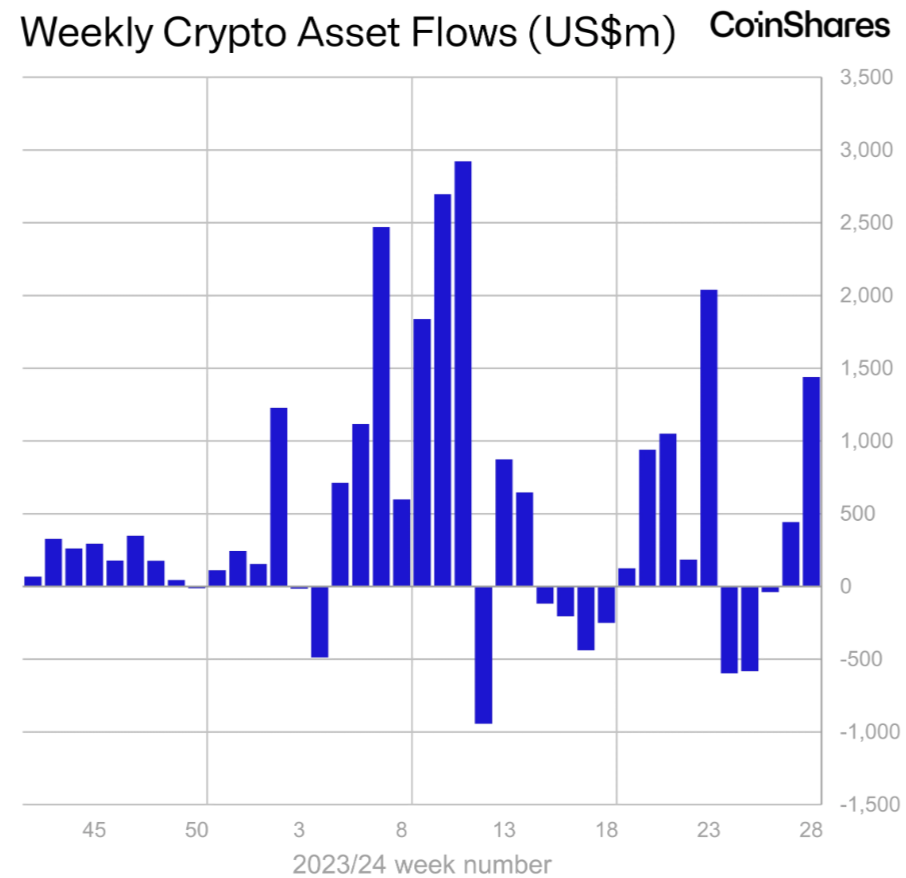

So far this year, over $17.8 billion has flowed into digital asset investment products, suggesting a possible recovery in the crypto market.

Last week alone, cryptocurrency investment products saw $1.44 billion in inflows, setting a new record. CoinShares data shows that the year-to-date inflows for 2024 have reached $17.8 billion, surpassing the previous record of $10.6 billion set in 2021.

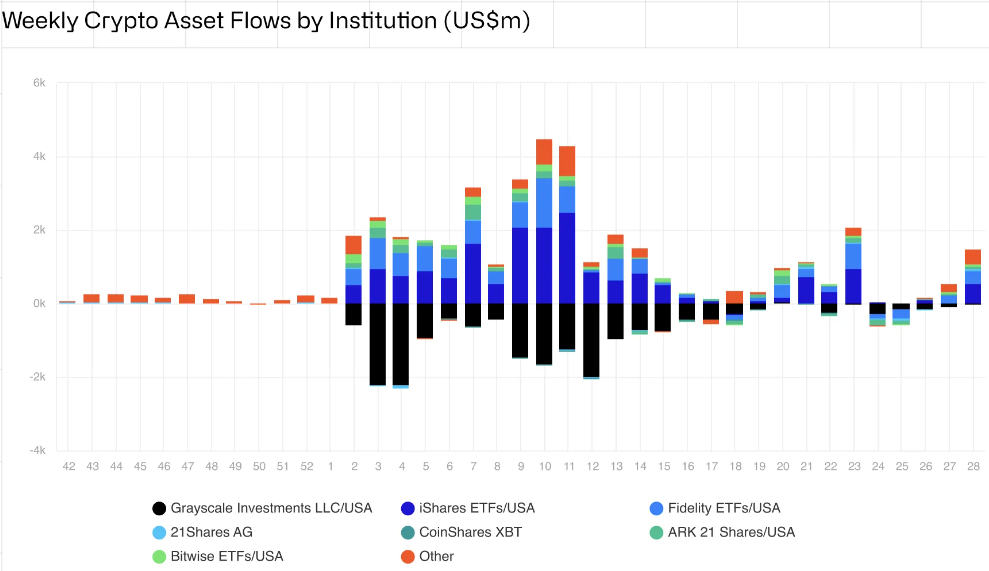

According to the report, most of the inflows are from buyers in the United States, with Switzerland also purchasing record amounts of digital assets. CoinShares stated:

“Regionally, the US led with US$1.3bn for the week, although the positive sentiment was seen across all other countries, most notable being Switzerland (a record this year for inflows), Hong Kong and Canada with US$58m, US$55m and US$24m respectively.”

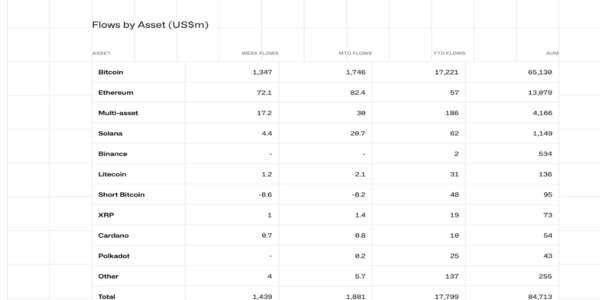

Bitcoin sees fifth-largest weekly inflows on record

Bitcoin, priced at $62,602, saw its fifth-largest weekly inflow ever, with over $1.35 billion coming in. This big boost helped Bitcoin climb back above $60,000.

At the same time, investment products betting against Bitcoin had their largest weekly outflows since April 2024, losing over $8.6 million.

Last week’s surge in Bitcoin buying was probably due to a price drop, partly because the German government sold some BTC. CoinShares reported:

“We believe price weakness due to the German Government bitcoin sales and a turnaround in sentiment due to lower than expect CPI in the US prompted investors to add to positions.”

Ethereum attracts $72 million in inflows ahead of Ethereum ETF

Ethereum, priced at $3,340, had the second-largest inflows after Bitcoin, with over $72.1 million coming in last week.

These inflows are likely due to the excitement around the first spot Ethereum ETF in the US, which could start trading in the next few weeks.

ETF issuers are expecting final comments from the SEC by early this week, according to an industry insider.

Several companies, including VanEck and 21Shares, updated their filings this week, hoping to get the SEC’s final approval to start listing spot Ether ETFs. In total, eight issuers are waiting for regulatory approval in the US.