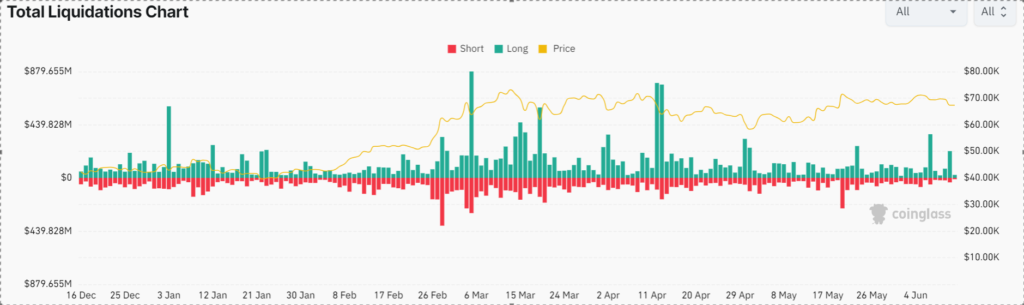

There has been another significant sell-off in the cryptocurrency market after a $400 million sell-off on Friday, June 11.

On June 11th, the price of Bitcoin dropped 2.5% from its peak of $69,547 to a low of $66,018. Ether dropped to $3,500, also by 2.58%. Leveraged trades suffered significant losses due to this drop in crypto values, totaling close to $200 million.

Crypto research firm CoinGlass reports that 83,912 traders lost all their money in the last day, totaling around $191 million. The largest loss took place in a single OKX trade, with a $5.21 million loss on an ETH for USDT transaction.

The exchange will sell off a trader’s interests to cover losses if they are not sufficiently funded or if they are unable to follow certain regulations set by the exchange. This implies that the trader may lose all the money initially invested.

Bitcoin and Ethereum Leverage Traders Face Major Losses

When the price of bitcoin fell to $67,487, traders suffered significant losses. They lost a total of $46.9 million on the final day. Of that, $36.8 million came from long bets, which wager on a price increase, and $14.07 million from short bets, which wager on a price decrease.

At $3523, ether’s price dropped, resulting in losses for traders. On the last day, they lost $41.0 million in total. Of this, $31.3 million came from long bets, meaning the investor anticipated a gain in price, and $9.68 million came from short traders, meaning the investor expected the price to fall.

Not too many days before this one, on Friday, June 7, the crypto market suffered a $400 million liquidation.

The recent market decline, which transpired due to significant losses in leveraged trading, has a connection to the Federal Open Market Committee (FOMC) meeting on June 12th and the approaching May Consumer Price Index (CPI) report.

Source: CoinGlass

Traders Eagerly Expect FOMC and CPI Updates

The release of Federal Open Market Committee (FOMC) interest rate decisions and data on the Consumer Price Index (CPI) has historically caused significant volatility in the crypto market. To lower risk, people immediately change their investments. The relationship between U.S. stocks and the crypto market is currently better than it has been since 2022.

Generally speaking, the price of Bitcoin decreases as the Consumer Price Index (CPI) rises. This holds true for other digital resources as well. People have less spare cash when essentials like groceries and other necessities rise in price. They thus have less money to invest in items like Bitcoin.

Based on sources, the Federal Open Market Committee (FOMC) intends to keep the current interest rate between 5.25% to 5.50%. The Consumer Price Index (CPI) data is also anticipated to remain within the range of 0.1% and 0.3%.