The instability in the crypto market caused Bitcoin to drop its value from its immediate resistance of $67K, making major Altcoin’s price drop by double-digits.

On June 18, the crypto market badly bleeds causing famous altcoins to drop their price by more than 10%, however, there is no clear cause.

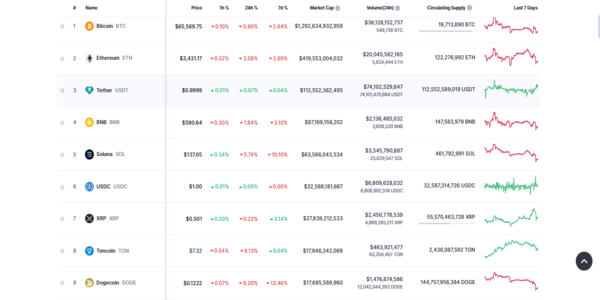

In the last 24 hours, the crypto market cap has significantly dropped 3.5% to $2.46 trillion. A major drop hit the altcoin making them bleed like Solana drop to 11.17% in the last 24 hours and trading at $135. The famous Dogecoin dropped by 13.25%, but Shiba Inu bled the most by dropping its price to $0.0000181 down by 19.04% as per CoinMarketCap data.

Other altcoins like ADA made a deep correction by 12.27% now trading at $0.37, Wif, Matic, and Polkadot also encountered a drop of 13.96%, 14.58%, and 8.91%. XRP and Toncoin remained on the list of unstable coins, up by 1.82%, and 6.87%.

The crypto-leading coins, Bitcoin, and Ethereum also encountered a drop of 3.20%, and 2.74% in the last 24 hours.

The chief investment officer at Apollo Crypto, Henrik Anderrson stated that he is unable to find out the cause of the recent drop in the crypto market, but he assumes that the decrease in the interest rate of spot Bitcoin ETF can be the major cause.

“[There’s] no clear catalyst from what I can see, but [it] looks like negative BTC ETF flows led to weakness in alts, which triggered liquidations of leverage long traders in Bitcoin, Ethereum and Dogecoin,” Anderrson stated.

Farside Investors published data on the last six days of Spot Bitcoin ETF trade, in which five out of six days of Bitcoin ETF encountered a significant outflow.

10xResearch also linked the recent altcoin bleed to the decline in spot Bitcoin ETF flows over the past week, suggesting that the cause-and-effect relationship is reversed.

“It has come as a surprise that Bitcoin is failing to rally despite weak inflation data, but the Ethereum and altcoin crash might have been predictable,” stated 10xResearch.

Bitcoin Miners See Double-Digit Gains Despite BTC Price Drop

According to an industry analyst, Bitcoin mining stocks have shown strong performance in recent weeks, recovering some of the losses experienced during April’s halving event.

“Mining stocks underperformed prior to the halving due to fears about post-halving profitability,” Mitchell Askew stated while talking to a crypto platform.

However, those fears have now subsided, and mining stocks are returning to equilibrium after previously underperforming relative to Bitcoin and its proxies like MicroStrategy.

Askew pointed out that the Valkyrie Bitcoin Miners exchange-traded fund (WGMI) is now up about 54% since the halving event, indicating renewed market confidence in the mining sector.