BlackRock’s IBIT was the first Bitcoin ETF to surpass $1 billion in inflows. The BlackRock Ethereum ETF, the iShares Ethereum Trust, might be the first U.S. spot Ethereum fund to reach $1 billion in net inflows.

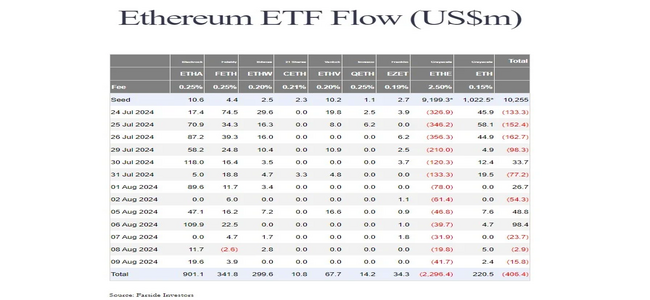

Trading under the ticker ETHA, the ETF has already gathered about $901 million in just three weeks since its launch and is quickly closing in on this milestone, according to data from Farside Investors.

Nate Geraci, president of The ETF Store, believes ETHA will surpass $1 billion in inflows this week, pointing out that it’s already ranked as one of the top six ETF launches this year.

Bitcoin vs. Ethereum ETFs: Growth and challenges

BlackRock’s iShares Bitcoin Trust (IBIT), which directly follows Bitcoin (BTC), was the first Bitcoin ETF to achieve $1 billion in inflows. It crossed that milestone in just four days, driven by a surge of consistent and substantial investments.

BlackRock’s data shows that Ethereum ETFs are accumulating funds at a slower pace compared to Bitcoin ETFs. While interest in Ethereum ETFs is rising, it hasn’t reached the same level as Bitcoin ETFs, which isn’t entirely surprising.

Martin Leinweber, Director of Digital Asset Research & Strategy at MarketVector Indexes, had anticipated more gradual inflows into Ethereum ETFs, unlike the massive billions poured into Bitcoin ETFs in a short period.

Bloomberg ETF analyst Eric Balchunas estimated that demand for spot Ethereum ETFs might only be 15% to 20% of what Bitcoin ETFs attract. He made this prediction following the significant approval of these products in May.

BlackRock’s ETHA is quickly emerging as the fastest-growing spot Ethereum ETF, but Grayscale’s Grayscale Ethereum ETF (ETHE) still holds the top spot in assets under management, despite experiencing nearly $2.3 billion in outflows after its transition from a trust.

Currently, ETHE manages $4.9 billion in assets, while ETHA has accumulated over $761 million. If ETHA continues its rapid growth, it could soon challenge ETHE in terms of AUM.

While ETHA shows strong potential to dominate the Ethereum ETF market, it’s still early days. With Grayscale’s Ethereum Mini Trust already established, more time and market developments will reveal how these funds compare.

The spin-off started with 10% of the trust’s assets and has since grown to $935 million in AUM. Even with steady investments flowing into this low-cost fund, its net inflows remain modest compared to the inflows into BlackRock’s ETHA.

BlackRock’s IBIT has surpassed Grayscale’s GBTC to become the largest spot Bitcoin fund by holdings. Currently, IBIT holds about 348,000 BTC, worth $21 billion.