Amidst this, BlackRock IBIT ETF stands out as a counter-example, currently sitting at $74. In September alone, the inflow of foreign currency stood at $9 million, raising the country’s foreign exchange reserves above $20 billion.

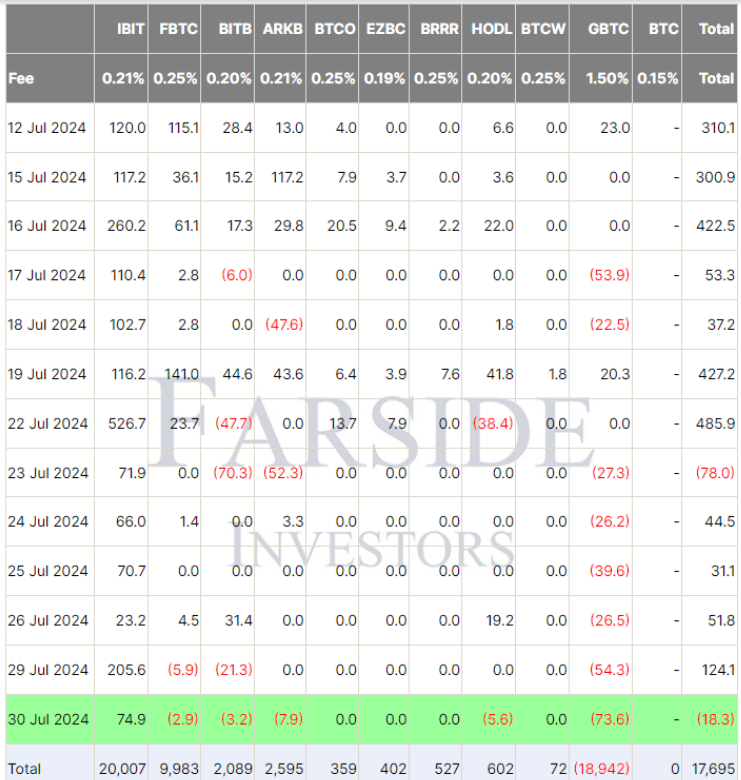

The following example shows that on July 30, Bitcoin ETFs posted an $18.3 million outflow, the first such exodus since July 23. Many large issuers, such as Bitwise, ARK, and Fidelity, saw outflows, while Blackrock’s IBIT ETF was an exception to this exodus, with a $74.9 million outflow.

This corresponds to $9 million in inflows, lifting the country’s net inflow total to over $20 billion. Grayscale’s GBTC witnessed its biggest monthly outflow since June 24, rising to $73.6 million for Itaú endpoints, while total ETF industry inflows reached $17.7 million.

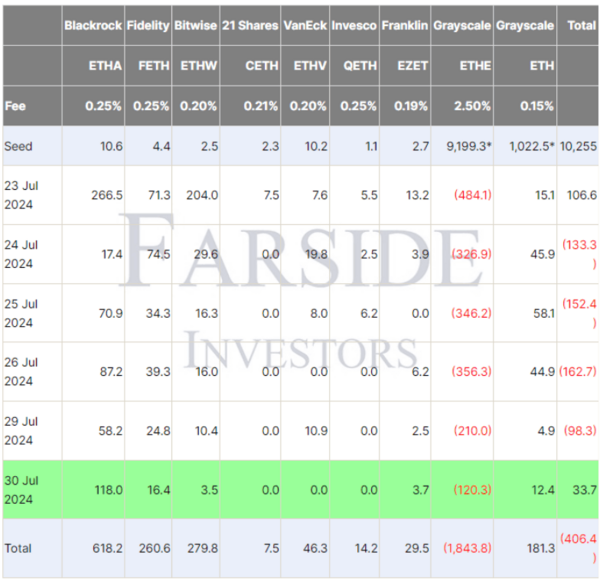

So far this year, the market in Ethereum ETFs has experienced a net asset increase of $33.7 million, which is higher than it was on July 23, although the total pedestrian death toll rose.

The smallest outflow at Grayscale’s ETHE was $120.3 million of outflows recorded for ARKK, while BlackRock’s ETHA saw a $118.00 million inflow that marked the highest since July 23.

This reduced the total outflow in ETH ETFs to $406. It revealed that BlackRock’s ETHA received a significantly bigger inflow than IBIT, the Bitcoin ETF product.