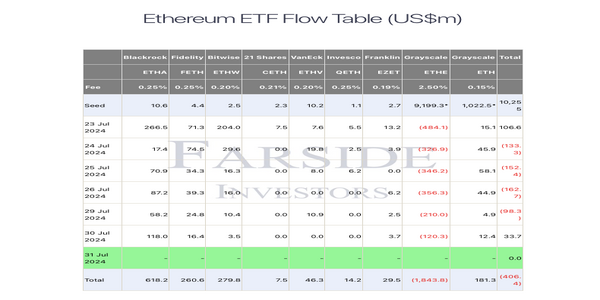

The United States spot Ethereum ETFs turn positive even after recording a major outflow in Greyscale ETF funds of $2B. Ethereum Exchange-traded funds recorded a net inflow of $26.7 million on August 1 injected by BlackRock’s fund.

On August 1, the net inflow witnessed by the Ethereum ETF was $26.7 million, injecting $89.6 million of funds into iShares Ethereum Trust and BlackRock‘s trust, as per Farside Investors data.

While seeing a total outflow, only GreyScale Ethereum ETF witnessed an outflow of $78 million on the day of its launch, and the total outflow reached $2 billion when converted into spot funds.

Ethereum ETFs Turn Positive

The other eight Ethereum ETFs, were launched on July 23 as newborn funds. Grayscale ETH was the only ETF that exposed institutional investors to Ethereum and was converted to ETH on July 23.

Besides the ETHE conversion into a spot, the asset still holds $9 billion in funds. As of today, 22% of the initial funds have just gone into the initial outflows.

Mads Eberhardt, Steno Research senior analyst, predicted that the large outflows from Grayscale’s ETHE would drop by the end of the week. He added that this decrease in outflows is a positive sign for ETH prices.

Kaiko’s head of indexes, Will Cai stated on July 23 that the price of Ethereum can be affected by the inflow in Spot Ethereum funds.

At the time of writing, Ethereum is trading at $3,152, with 0.61% down in the last 24-hour trading as per CoinMarketCap data.