Stephen Richardson, Managing Director of Financial Markets & Head of APAC at Fireblocks, predicts that the Ethereum ETF can only grab 10-20% of the funds inflow that Bitcoin ETF did on the first day of its launch.

Bloomberg analysts also said that Ethereum ETF cannot beat the first-day funds inflow of Bitcoin ETF. Fireblocks executives warn traders because Ether’s uses are harder to value.

On Jan 11, spot Bitcoin ETF traded for the first day and gained a massive inflow of $655.2 million, far above the industry’s expectations.

While Bitcoin has a reliable store of value, it’s harder to measure the value of Ethereum’s tech-driven investment uses, says Stephen Richardson.

“What’s missing is widespread consensus that effectively evaluates the utility or utilization rate of the Ethereum blockchain.”

Richardson explained,

“The right value metrics and drivers need to first be created to be able to assess the adoption or utilization of the technology to derive its value then,”

As a result,

“We’re likely not going to see the same levels of inflows on day one with the Ether ETFs as we saw with the Bitcoin ETFs,” he concluded.

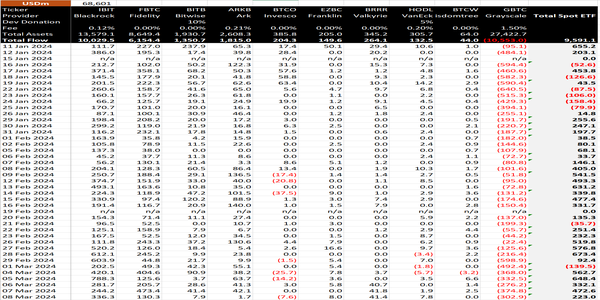

The chart below shows the most inflows on the first day of its launch. On the first day, Bitcoin ETFs launched at $237.9 million, followed by Blackrock‘s IBIT at $111.7 million, and Fidelity‘s FBTC started its trade at $227 million, as per BitMEX Research data.

Richardson suggested evaluating Ethereum by looking at the total value locked (TVL), a metric already used to assess Ethereum and its layer 2 blockchains. However, he said that more comprehensive metrics are needed for further evaluation.

The number of users and transaction volume can be used to access the Ethereum adoption, suggested by VanEck, the recently approved spot ETH ETF.

Asked for a powerful one-liner to tell potential investors about spot Ether ETFs, Richardson said that Ethereum is the “best bet” to lead the digital space and attract more retail and institutional investors on-chain.

“Ethereum’s value is intrinsically linked to the use cases that are being built on top of it, so investors are making a bet on the utilization of the software itself.”

Markus Thielen, head of 10X research, suggested that Ethereum can enter as a “network empowering the future of finance.”

He further explained that Ethereum’s revenue is very low compared to its $455 billion market cap, which means it isn’t a “viable, cash-flow-generating investment.”

The SEC approved 19b-4 applications on May 23 from VanEck and some others to issue spot ETH ETF.

VanEck and others must wait until the SEC signs an S-1 filing to start ETH ETF trading.

After signing S-1 filing, analysts like James Seyffart, and Eric Balchunas predict that Ethereum ETF can only gather 10-20% of funds as compared to Bitcoin ETF.

Since the launch of the Bitcoin ETF, it gathered almost $13.8 billion of funds, according to Farside Investors.

Capturing 15% of that would still mean spot Ether ETFs reach a total of $2.07 billion in the same time period, which is impressive for the industry.