The second day of U.S. spot Ethereum ETF trading was a letdown, with investors withdrawing around $113.3 million. Grayscale’s Ethereum Trust ETF took the biggest hit, experiencing over $800 million in net outflows.

The situation left many puzzled. Some Ether ETFs stayed positive during U.S. trading, but the overall mood was far from upbeat.

The sudden outflow caused ETH’s price to drop by 1.8% that day, likely fueling a cycle of negativity as investors decided to cut their losses.

Ethereum ETFs Struggle as Bitcoin Dominates

Interestingly, the outflow happened despite Ethereum ETFs performing well during the trading day. So, why the exodus? It seems confidence in ETH’s near-term prospects is shaky, possibly due to broader market trends or the large withdrawals from Grayscale’s fund.

Bitcoin ETFs overshadowed Ethereum ETFs from the start. On their first trading day, Ethereum ETFs only captured 16% of the net flows that Bitcoin ETFs did.

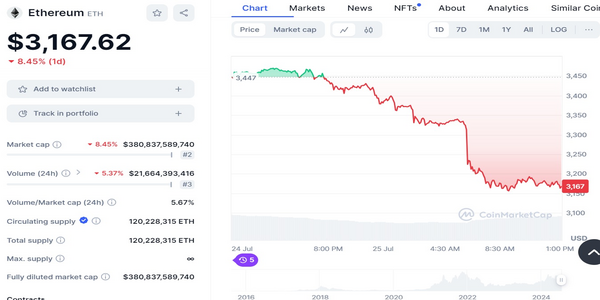

This lukewarm performance might explain the quick outflows on the second day. At press time, Ether was worth $3,167.62, down 8.45% in the past 24 hours.