After the unexpected approval by the SEC, spot Ethereum ETFs became a hot topic in the crypto world. However, their first week of trading didn’t meet expectations, showing an underwhelming performance.

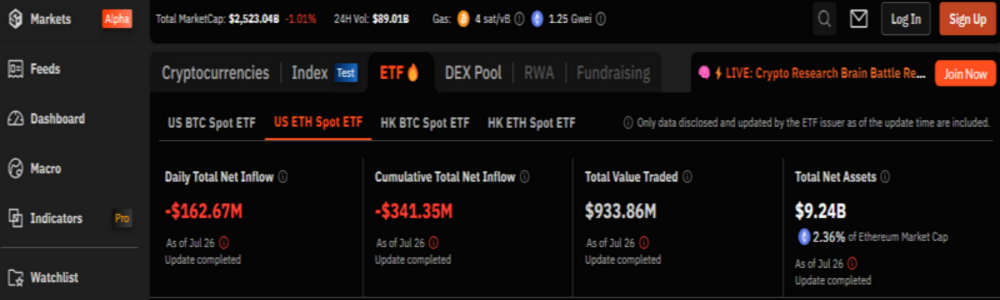

On July, 26th, the new spot Ethereum ETFs experienced significant outflows for the third straight day. Launched on Tuesday, July 23rd, these ETFs have seen a net outflow of approximately $341 million in their opening week.

According to SoSoValue data, spot Ethereum ETFs had a strong start with a net inflow of about $106.8 million on their first day, which market experts called a “solid start,” especially compared to Bitcoin ETFs launched earlier this year.

However, the momentum quickly reversed. On Wednesday, July 24, over $133 million flowed out of the ETFs, followed by net outflows of $152 million on Thursday and $162 million on Friday.

Grayscale’s ETH Trust (ETHE) has been a major player in the recent capital outflow, with over $356 million withdrawn in a single day on Friday. Despite this, the Grayscale product has still seen a cumulative net inflow of $1.51 billion since the launch of spot Ethereum ETFs.

The price of Ethereum has struggled following the launch of these ETFs. According to CoinGecko, Ethereum has dropped over 7% in the past week. Currently, ETH is valued at around $3,248, down 1.1% from the previous day.

Ethereum ETFs show less market impact than Bitcoin

According to CryptoQuant’s latest report, new investments like ETFs impact Ethereum less than Bitcoin. This is based on the “realized capitalization multiplier” metric.

The data reveals that every dollar invested in Bitcoin can boost BTC’s market capitalization by $5. In contrast, for Ethereum, each dollar invested only raises its market cap by $1.3.

This shows that in 2024, Ethereum’s multiplier effect has been much lower than Bitcoin’s.