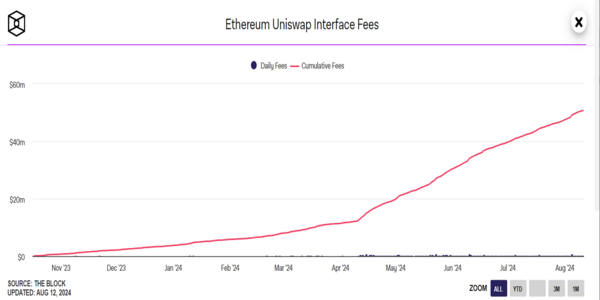

Uniswap Labs touched a new milestone by earning revenue of more than $50 million in uniswap front end fees. It is the same company behind the development of the Uniswap protocol.

On October 18, 2023, the protocol enhanced its fee structure and charged a 0.15% fee to certain cryptocurrencies on its web interface and wallet. The tokens affected by this change are LUSD, ETH, USDC, agEUR, WETH, USDT, DAI, WBTC, EUROC, GUSD and XSGD.

This change in fee structure resulted in generating a revenue stream for the protocol. In the middle of April, the protocol further enhanced the fee structure from 0.15% to 0.25%. This change spiked the revenue from $3.7 million on Jan. 1 to over $50.6 million at the time.

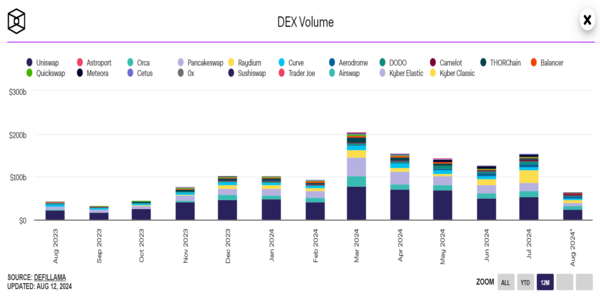

Uniswap remains the largest decentralized exchange by trading volume, handling nearly one-third of all DEX transactions in July. According to The Block’s data dashboard, Uniswap processed $54 billion out of the total $154 billion in swap volume for the month.

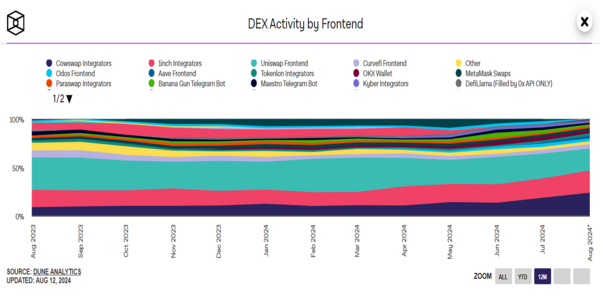

Users wanting to bypass the front-end fee can use Decentralized aggregators like 1inch, Cowswap, and Paraswap. In July, Uniswap front end accounted for 25.7% of DEX activity, while 1inch, the most popular DEX aggregator, captured 19.8%. This is based on the monthly share of activity generated by DEX frontends.