Benjamin Cowen, founder of Into The Cryptoverse, predicts that if Ethereum’s supply keeps increasing, it will return to levels seen before the Ethereum merger in September 2022.

An analyst warns that Ethereum’s price may drop after the initial excitement around spot Ethereum exchange-traded funds (ETFs) fades, especially if its supply continues to grow at the current rate.

Crypto trader and Into The Cryptoverse founder, Benjamin Cowen, posted on X on July 19, discussing the significant Ethereum Merge.

This occurred in September 2022, transitioning Ethereum (ETH) to its current proof-of-stake consensus model.

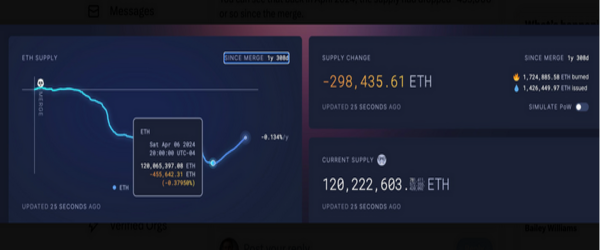

After the Ethereum Merge, Ethereum became deflationary, and its supply decreased by about 455,000 ETH by April 2024.

However, since then, the supply has grown by around 150,000 ETH. Cowen suggests that if this growth continues, the supply could return to what it was before the Merge over two years ago.

“If the supply of ETH keeps increasing at 60,000 ETH per month, then we will see the supply revert to what it was back at the merge,” Cowen stated.

Ethereum price may drop below its current level by September

Moreover, he thinks that in 1.5 years, Ether’s price will probably be higher than it is now. However, there is a good chance it will go down in the next 3–6 months. Currently, Ether is trading at $3,490, according to CoinMarketCap.

Just a few days ago, onchain analyst Leon Waidmann mentioned that Ethereum is experiencing a “supply crisis.”

On July 16, Waidmann posted on X, saying that most investors don’t understand how “tight” the ETH supply is.

Five spot Ethereum exchange-traded funds (ETFs) are set to start trading on the Chicago Board Options Exchange on July 23, as long as regulatory approval is confirmed, CBOE announced on July 19.

On May 23, the SEC approved rule changes allowing the listing of these spot Ether (ETH) ETFs.

The five ETFs launching are the 21Shares Core Ethereum ETF, Fidelity Ethereum Fund, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and Franklin Ethereum ETF.