The monthly average change in BTC retail demand further drops from the last month. Some analysts predict it to be a drop before a major price surge, as seen earlier this year.

The average Bitcoin price encountered a drop in its value among retail investors and reached the lowest level in five months since the price seen in January. After that, the price spiked to a new high, providing a 75% appreciation in the price for the next two months.

CryptoQuant author Axel Adler shared data on X on June 10, which witnessed a drop of 17% in the price of Bitcoin among retail investors. The price change is from the last 30 days of Bitcoin trading.

CryptoQuant explained that “a similar previous drop to -18%” was seen in January, which propelled the price of BTC from $40,000 to $70,000, when spot BTC ETF got approval from the United States Security and Exchange Commission, and in March, BTC hit its all-time high to $$73,679.

“I also noticed that this cohort reacts quickly to any market changes,” Adler said.

In the last month, Adler noted that demand dropped by 31% in the 17 days before May 24, reaching a negative 14.50%. He suggested this decline might be due to rising interest in GameStop (GME) and Ether (ETH), possibly driven by the initial approval of spot Ethereum ETFs.

The shift in demand for BTC has several factors, according to the analysts one of them can be the inflation-tracking U.S. Consumer Price Index (CPI).

The drop in the CPI makes riskier assets like Bitcoin, more attractive to investors because traditional savings and term deposits offer lower returns as interest rates drop.

10x Research head researcher Markus Thielen stated while talking to a news platform that the CPI must drop to 3.3% on June 12 to see new records, when the U.S. Bureau of Labor Statistics will publish the data.

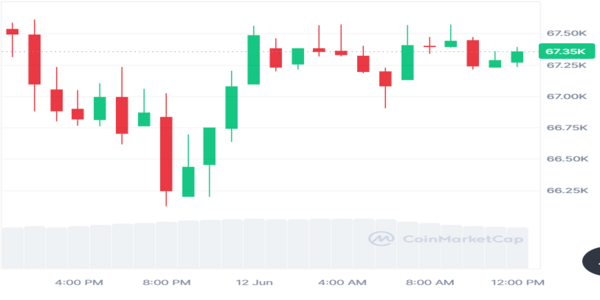

On June 11, BTC dropped its price to $69,000 after the United States published employment data. At the time of writing, BTC is trading at a price of $67.352, according to CoinMarketCap data.

Source: CoinMarketCap

The drop in Bitcoin’s price resulted in cthe closing$52.87 million of long positions in the previous day. The open interest rate remained at the $35 billion mark as per CoinGlass data.

Despite the upcoming CPI results on June 12, future traders don’t seem to expect a near-term recovery for Bitcoin. If Bitcoin regains its value to $70,000, there is a chance of liquidating $2.14 billion of short positions.