The leader in cryptocurrency asset management withdraws the Ethereum ETF application just two weeks before the SEC regulator can decide on at least one spot Ether ETF application.

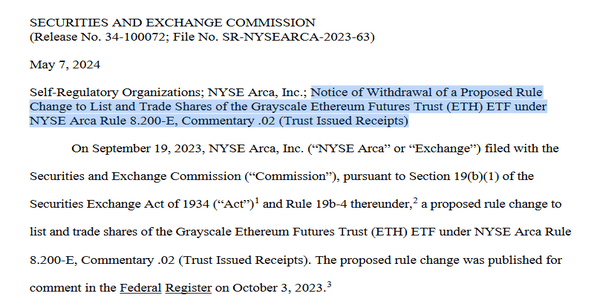

The prominent player in cryptocurrency asset management, Grayscale, has surprisingly withdrawn its 19b-4 application for a futures Ethereum exchange-traded fund filed on May 7. In September 2023, this company was registered with the Securities and Exchange Commission, and it is now withdrawing its application to the SEC.

The withdrawal of the application created panic among investors, as there was no particular reason for it. This step connects with the recent pause by the SEC regarding crypto assets

Source: SEC

The withdrawal of the Ethereum ETF application from the market can result in a positive decision for Grayscale. An illustrative case involving the SEC is last year’s ruling in favor of Grayscale against its Bitcoin futures ETF. Even though the SEC approved Bitcoin futures providers, which provide recoveries to cryptocurrency during market crashes, the SEC still sided with Grayscale.

Grayscale’s ETF Withdrawal: Analyst’s Perspective

James Seyffart, the analyst at Bloomberg, initially believed that Grayscale would use this strategy to force the SEC into approving its spot Ethereum ETF. He showed mixed expressions as to why, at this time, Grayscale is taking its steps back. The SEC already has to accept or deny at least one ETH ETF application by May 23, just 2 weeks from now.

People on social media are making wild guesses about the delisting of Grayscale ETH ETF. Some of them believe that this is because of the SEC rules against spot ETf, however, Seyffart didn’t feel the same. Re-filing for the ETF might be the SEC’s careful response to Grayscale and others’ legal issues.

Challenges in Regulatory Security for Ethereum ETF

The analysts are unsure about the SEC approval of the ETH, but Grayscale withdrew its application. As seen, the SEC-approved spot Bitcoin ETF, which is a clear indication of a Bitcoin price surge, might be making the market gear up for the bull run.

The chances of Ethereum spot ETFs failing are rising, especially after a setback last year. The SEC rejected them because they considered Ethereum as a regulated security. This conflicts with an earlier SEC statement saying they didn’t plan to regulate Ethereum.