Grayscale‘s Bitcoin ETF experienced a rapid outflow of funds estimated as $66.9 million, more than it attracted in previous days.

The rare Grayscale Bitcoin spot Exchange Traded Funds (ETF) evaporated in just two days as outflow strikes it.

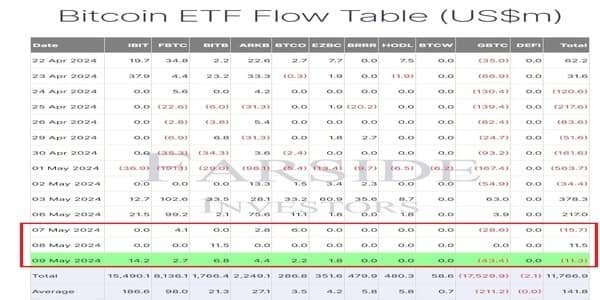

The Grayscale Bitcoin ETF, launched on January 11, recorded inflows worth $66.9 million after a straight outflow of $17.5 billion in 78 days since its launch. This investment came on May 3, and 6, each day collecting $63 million and $3.6 million. However, the ETF fails to maintain inflow momentum

Source: Farside

The Grayscale Bitcoin Trust (GBTC) recorded major outflows on May 7, and 9. This outflow was worth $28.6 million and $43.4 million, respectively. On these days, Grayscale was the only one to report the outflow of funds, as it failed to keep up with the pace of inflows.

The United States Security and Exchange Commission approved nine other ETFs along with it. All of the other ETFs are giving a positive response during this time, except the Grayscale ETF.

On average, Grayscale Trust has lost $211 million since its launch; however, other ETFs keep the net balance positive by $11.7 billion.

Among all the ETFs approved by the US SEC, BlackRock’s iShares Bitcoin Trust has attracted the most inflow, reaching up to $15.5 billion to date. Other notable issuers comprise Fidelity’s Wise Origin Bitcoin Fund, Bitwise Bitcoin ETF, and Cathie Wood’s ARK 21 Shares Bitcoin ETF, which currently boast net inflows of $8.1 billion, $1.7 billion, and $2.2 billion, respectively.

VanEck expected significant institutional investments from banks and traditional firms to materialize by May.