Delve into a detailed analysis examining the evolving profitability of Bitcoin mining, exploring essential factors shaping its viability amidst the dynamic cryptocurrency environment.

It may not be as simple as it once was to profit from Bitcoin mining, based on recent data.

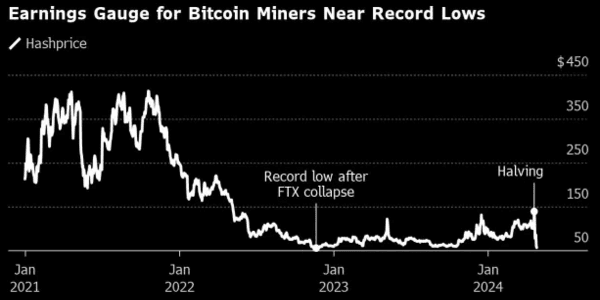

According to a Bloomberg study, the profitability of mining Bitcoin is declining, at a level not seen since the collapse of FTX. As a result, those who work on safeguarding the Bitcoin network are finding it difficult.

Data shows that the “hash price” which calculates the daily profit a miner receives for each unit of processing, has reached its lowest point ever.

There has been a noticeable decline. It happens after the April 20 Bitcoin halving. Halving increases the value of halving but not this time. There was a lot of economic uncertainty worldwide and it sparked a downward trend.

Luxor Technologies came up with the phrase “hash price” that indicates the difficult situation that miners faced following Halving. This event takes place every four years and reduces the miners’ block reward by half. It aims to maintain a deflationary timeline for Bitcoin issuance.

Decrypting Bitcoin’s Hashrate Pricing

The Bitcoin hash price increased to $139 on April 20, right after the halving. The primary cause of the increase was a rise in transaction fees associated with the use of the Rune protocol on the blockchain of Bitcoin.

Source: Bloomberg

The hash price fell to $57, as low as $55 in November 2022, because the fees went back to normal and mining became more difficult. Minors are now making less money because of this situation and are dependent on transaction fees. Miners hope that the price of Bitcoin will rise. A decline in the profits of mining indicates difficulties down the road, especially for smaller mining operations.

Bloomberg stated that the decline in profitability had led to major mining businesses. It includes Riot Platforms, Inc. and Marathon Digital Holdings, Inc., to make important investments in infrastructure and advanced equipment.

On the flip side, smaller businesses could struggle to maintain profitability in a market that is becoming more competitive. These demand a large amount of funding.

Marathon Digital: Scaling Through Strategic Expansion

Due to the challenging circumstances, Marathon Digital has raised its 2024 hash rate growth target. They are getting used to the 3.125 BTC new mining incentive following the halving.

Marathon Digital could hash at a rate of 24.7 hours per second at the start of the year. There was a 40% increase was set up for this. Marathon hopes to achieve a hash rate of 50 EH/s through acquisitions and more equipment procurement.

Chairman and CEO of Marathon, Fred Thiel, is optimistic that the company will meet these expansion goals without requiring further funding. His optimism stemmed from the good cash position of the company.

Thiel mentioned:

Given the amount of capacity we have available following our recent acquisitions and the amount of hash rate we have access to through current machine orders and options, we now believe it is possible for us to double the scale of Marathon’s mining operations in 2024 and achieve 50 exahash by the end of the year.

Source: Tradingview

Marathon aims to increase the productivity and technology of mining. Achieving an operational efficiency of 21 joules per terahash is their aim. The purpose of this try is to strengthen their position as a leader in the sector.