JPMorgan criticized the public Blockchain ledger, but traditional financial institutions still use it for tokenizing real-world assets.

Public Blockchains are not capable of executing large amounts of transactions, as said by JPMorgan.

In a summit held on May 7, the CEO of JPMorgan’s Onyx, Umer Farooq, said

“I think you almost need something like [a Unified Ledger]. I mean, it’s actually almost a necessity because if you look at […] public blockchain ledgers, they are not fit for purpose for large transactions today.”

Umer Farooq passed this comment while responding to Unified Ledger. During the last year, the Bank of International Settlement introduced this concept, which will help to support central bank money flow, the deposit of tokens, and the digital flow of funds on its network.

The CEO explained it further, If a $100 million transaction were to fail, public blockchain validators are not accountable for it.

“Who do I sue? […] You need to get somewhere where people can do trusted transactions between financial institutions with some sort of accountability in the system.”

Even after the criticism of the CEO, JPMorgan‘s bank-led Onyx platform. This platform is based on the private, permissioned version of Ethereum, which is the world‘s second-largest blockchain network. This platform allows the institution to reverse the transactions.

The CEO, Farooq, said that the cryptocurrency on the public blockchain provides false incentives, which result in an increase in the price of the token and attract more users. He stated that we should consider blockchains, like the internet, a public good.

“We need to get to an evolution point where the technology starts to be seen as a public good versus as a means to enrich.”

While speaking to the organization, Celisa Morin, the vice president of Greyscale until mid-2022, said that the recent step taken by the blockchain can attract more traditional institutions to tokenize assets on the public blockchain compared to the private blockchain. She stated that

“I think we see a preference for private chains with JPMorgan’s Onyx. But I do think that this was the narrative a few years ago. Now, I think it’s very much the public blockchains.”

Morin was talking about BlackRock’s $100 million tokenized “BUIDL” fund, launched on the Ethereum network on March 18.

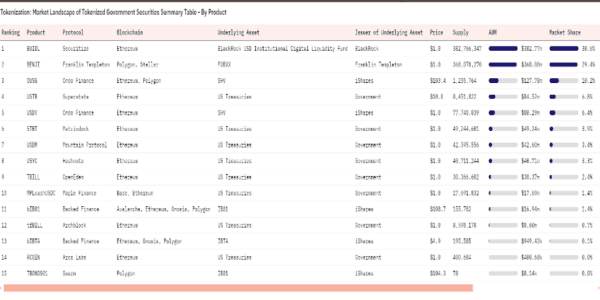

According to Dune data, BlackRock’s BUILD holds $382, making it the world‘s largest tokenization fund.

Source: Dune