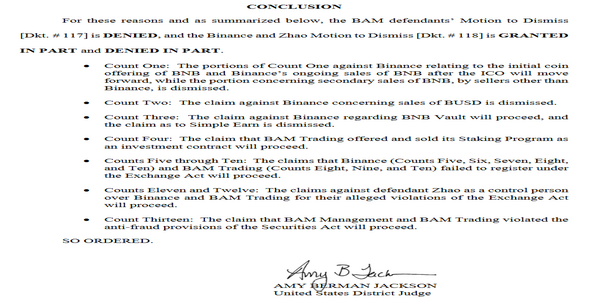

On Friday, in the SEC and Binance case, Judge Amy Berman Jackson ruled that the SEC can proceed with the initial allegations on Binance for ongoing BNB token sale, initial coin offerings, failure to register, and fraud charges.

The Judge dismissed the allegation of SEC on BNB token trading on secondary exchanges by citing the XRP decision. The judge stated to proceed in a June 28 ruling. Jackson also eliminated the allegation of passive income, claimed by the SEC

The SEC’s claim that Binance CEO Changpeng Zhao acted as a “control person” will proceed, along with the claim that Binance was required to register under the Exchange Act.

However, it wasn’t a complete victory for the Securities and Exchange Commission, as Jackson decided to dismiss claims related to BNB secondary market sales and all sales associated with the Binance USD (BUSD) stablecoin.

Jackson Dismisses SEC Claims Against Binance, Citing Ripple Ruling

Jackson referenced Judge Analisa Torres’ ruling in the SEC’s case against Ripple to justify her decision to dismiss the SEC’s claim regarding BNB secondary market sales. In the Ripple case, Judge Torres ruled that the secondary market sales of XRP did not constitute securities transactions.

Drawing on this precedent, Jackson determined that the SEC’s allegations concerning BNB secondary market sales similarly failed to meet the criteria for securities violations. As a result, these particular claims were excluded from proceeding in the case against Binance.

FOX Business reporter expects lawyers at Coinbase, and Kraken to “use this opinion to bolster their positions in their own litigations.”

Binance and CZ also filed a lawsuit against the SEC for overstepping its legal authorities.

Seven U.S. states have revoked or denied the renewal of Binance’s money transmitter license.

Additionally, former Binance CEO Zhao is currently serving a four-month prison sentence for violating money laundering laws.

Despite these challenges, Binance remains the largest cryptocurrency exchange globally, with over 200 million users and $100 billion in assets under management.