More than half, or 54% of institutional investors in Japan, plan to invest in cryptocurrencies within the next three years due to high returns and diversification of their portfolio. More than 50% of the institutional investors in Japan will establish operations in the crypto space by 2024.

On June 24, Nomura Holdings, a Japanese financial giant, and Laser Digital, its digital asset subsidiary, released the results of the “Institutional Investor Survey on Digital Asset Investment Trends.”

The survey was conducted on 547 investment managers, which included institutional investors, family offices as well and public-service corporations.

The survey was designed to identify the perceptions Japanese investment managers have about digital assets and to illustrate the major factors that influence their decision to invest in cryptocurrencies.

Rising Interest and Optimism: Trends in Market Sentiment

About 54% of the respondents indicated their intention to invest in crypto investments within the next 3 years, with most of them either willing or more likely to invest in one, while the rest are unlikely or unwilling to invest in one.

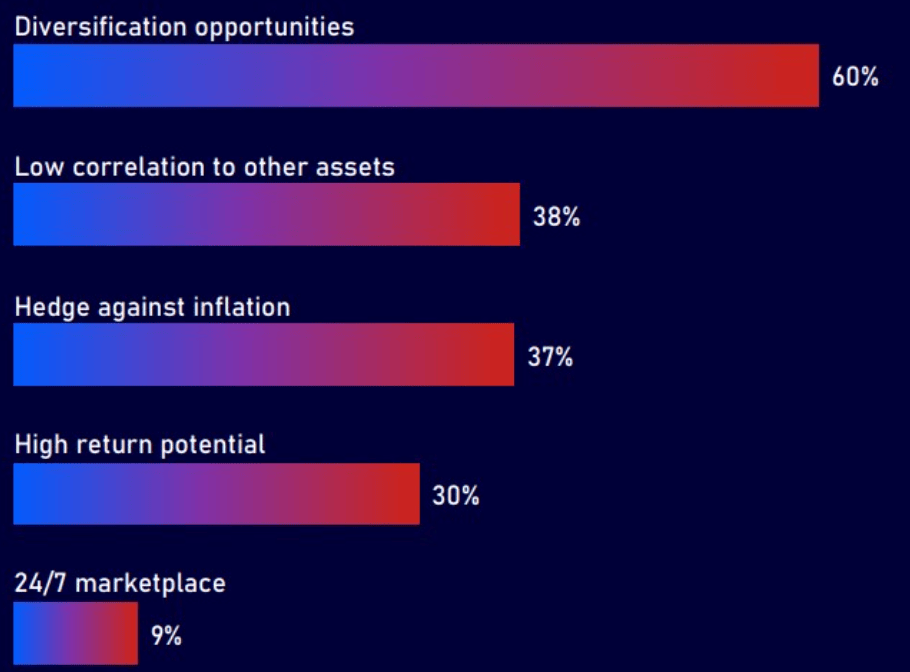

The desire for diversification was the primary reason given by 60% of the respondents as to why they want to invest in digital assets in the form of crypto assets.

Other reasons that contributed to the interest in crypto investments were its diversification from conventional assets, speculation of acting as an inflation hedge, higher potential returns, and constantly operating trading markets.

The majority of the managers in the survey preferred to allocate 2-5% of their assets to crypto investments within the next 3 years, with 66% of the response falling in this category.

Furthermore, 25% of respondents had a ‘positive’ attitude towards crypto assets, indicating that they expect further expansion of the crypto sector in Japan.

Exploring Drivers and Barriers to Investment: Implications Coming from Japan

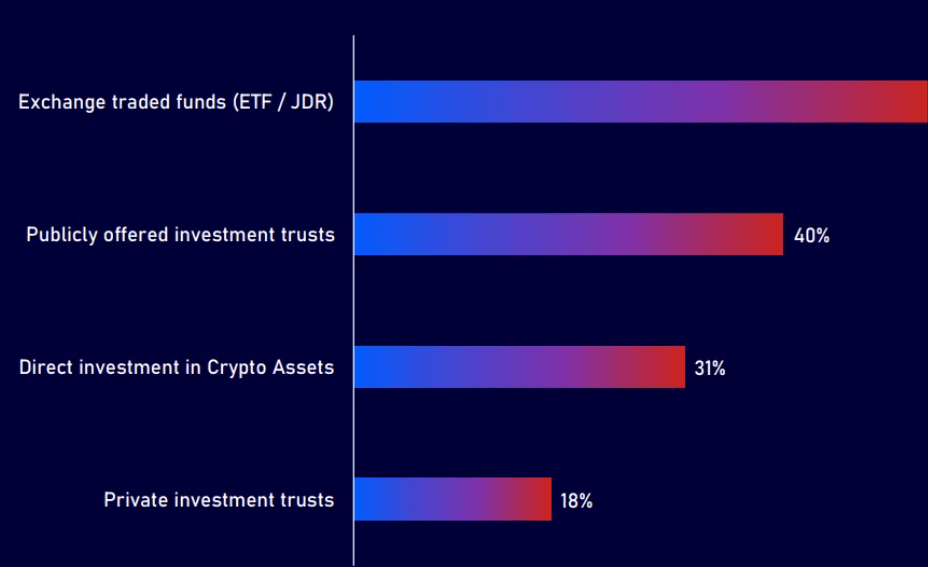

Concerning the motivations to engage or remain in the crypto market, the survey pointed to the following: Crypto ETFs and investment trusts, staking opportunities, and lending presumably drove those already invested in cryptocurrencies or willing to invest or get involved.

Almost a third of the participants of the survey also expressed that they are bullish on Web3 and are either directly investing or invested in it through venture capital.

Some of these catalysts include the amendment of the Limited Partnerships Act that is expected to add cryptocurrency assets as among other forms of assets that can be offered to the Limited Partners (LPs).

Nevertheless, there are concerns that have made some investment managers hesitant about making direct investment in cryptos, which includes counterparty risk, volatility, and stringent regulation.