Binance CEO Richard Teng says investors are still very interested in Bitcoin ETFs, even though prices have recently dropped.

These ETFs have attracted more than $7.14 billion over the last six months, which means that there is liquidity to be gotten from them. This demonstrates a high confidence level in investors in Bitcoin (BTC) and other digital assets.

Teng’s findings support Bloomberg data illustrating that investors have no qualms with using the recent drop in the price of the stock as a means to start buying the stock. This has been evidenced in the last two days, where Bitcoin ETFs in the U. S. have seen an inflow of $438 million.

They hope for a better future than the present or the near future in light of market fluctuations and hence exhibit bullish sentiments.

Bitcoin (BTC) Price Outlook: Recent development and future estimate

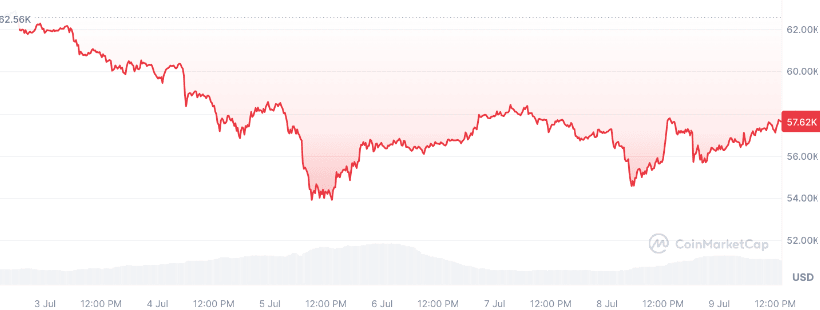

Since June, Bitcoin has shed nearly 25% of its value, the main concern sparking the sell-offs being the possible Mt. Gox creditor token sales as well as the withdrawal of tokens that are controlled by the German government.

Since Tuesday, Bitcoin has made gains amounting to over 3% to an average of $57,600 but still far from the records set in March.

The continuous inflows of ETF and the slight bounce back of its price indicate that the market volatility would never defeat BTC’s ongoing strength and promise in the long run.

Having a long-term vision is essential, with leaders such as Teng focusing on building more robust fundamentals to drive the ecosystem forward rather than being fixated on the volatility of its price.